If you are looking for a bank statement template, there might be two reasons for that. First, you want to prepare your own template for your financial institution and the second reason is that you just want to know what a bank statement actually looks like. Whatever the case might be, don’t worry because you are at the right place. In this article, we have a great collection of handy bank statement templates available for your use. You can easily download and customize any of the given templates and create your own with just a minimal effort.

What is a Bank Statement Template?

A bank statement or a bank statement template is a summary of all the financial transactions of a particular bank account issued by the bank itself. It is one of the most common financial documents that every bank is obliged to provide to its customers upon their request or even on a periodic basis e.g., on a monthly, quarterly, or yearly basis. Whether the customer is an individual or a business enterprise, it is the duty of the bank to provide them with a bank statement for their account.

A bank statement is also sometimes referred to as a bank account statement or account statement. It is an important document that should be kept by a business for record purposes. It helps you monitor your financial transactions on a periodic basis. Usually, the banks have a lot of accounts so that’s why they make use of a bank statement template to issue the statement to each and every customer.

Features of a Bank Statement Template

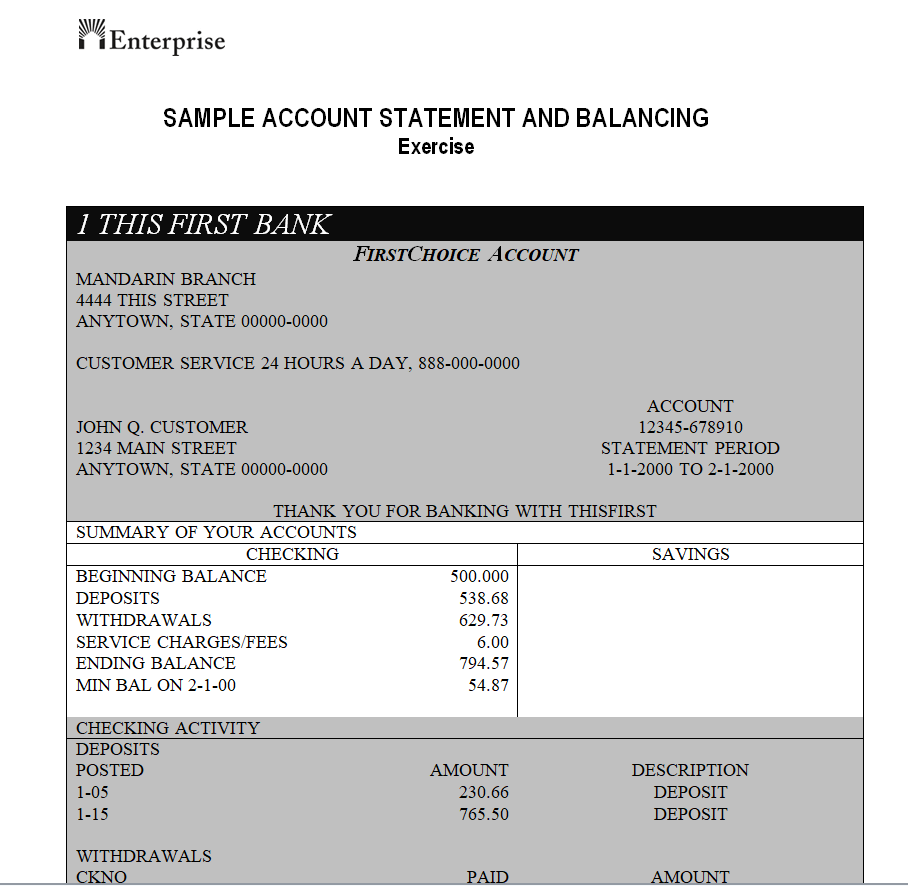

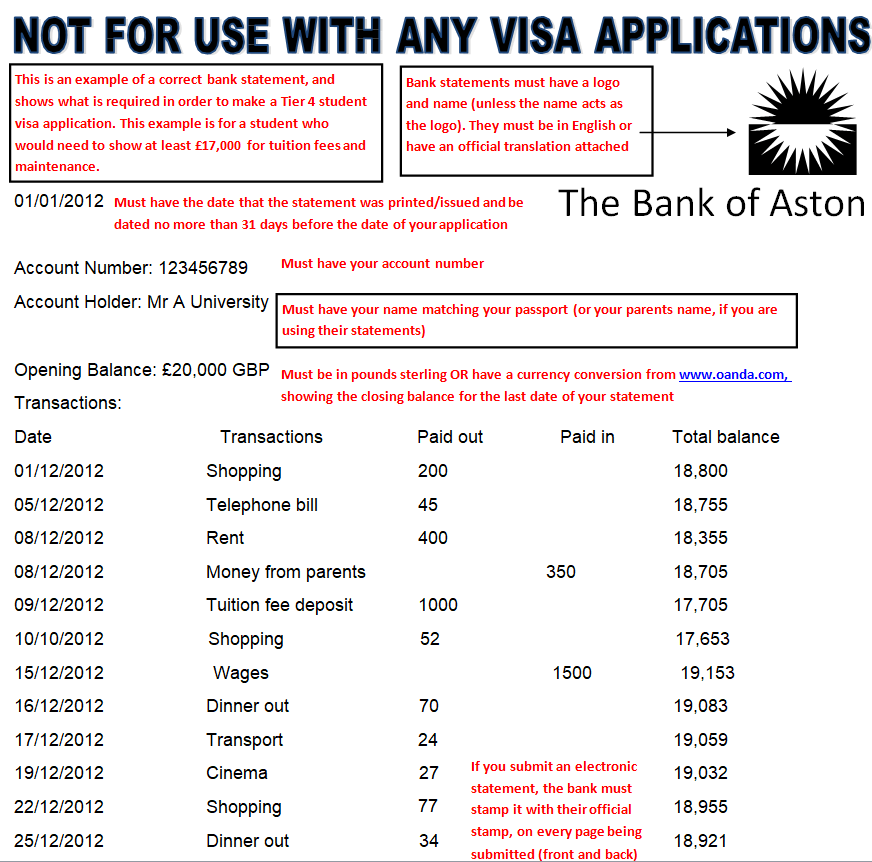

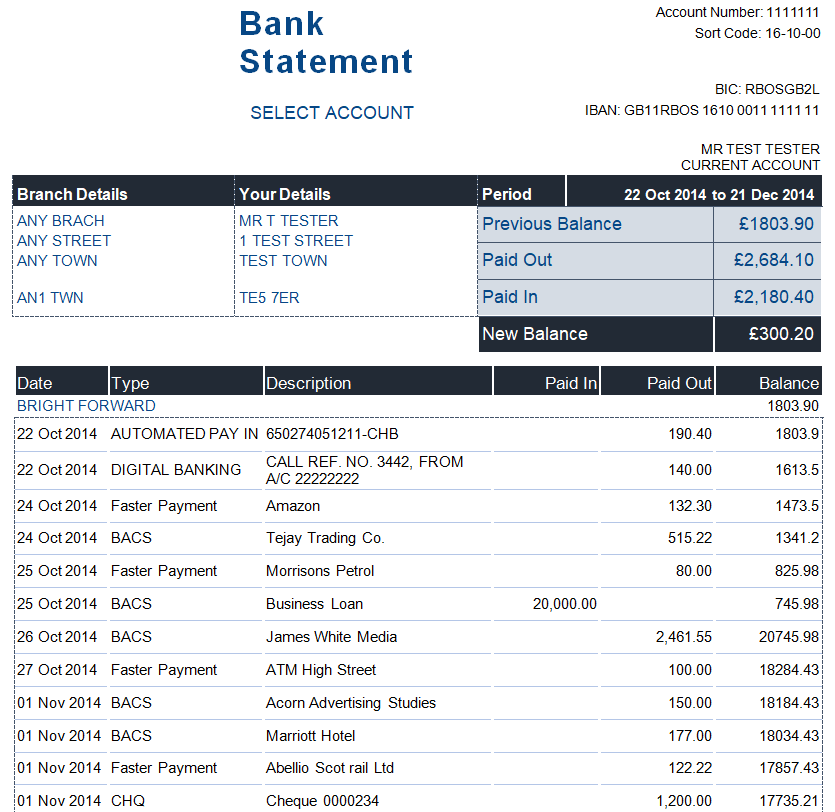

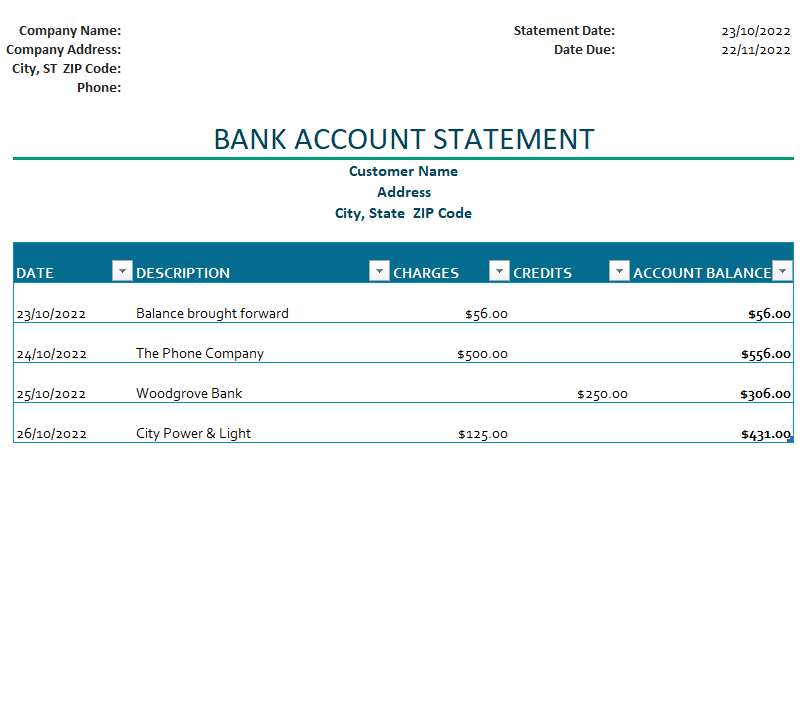

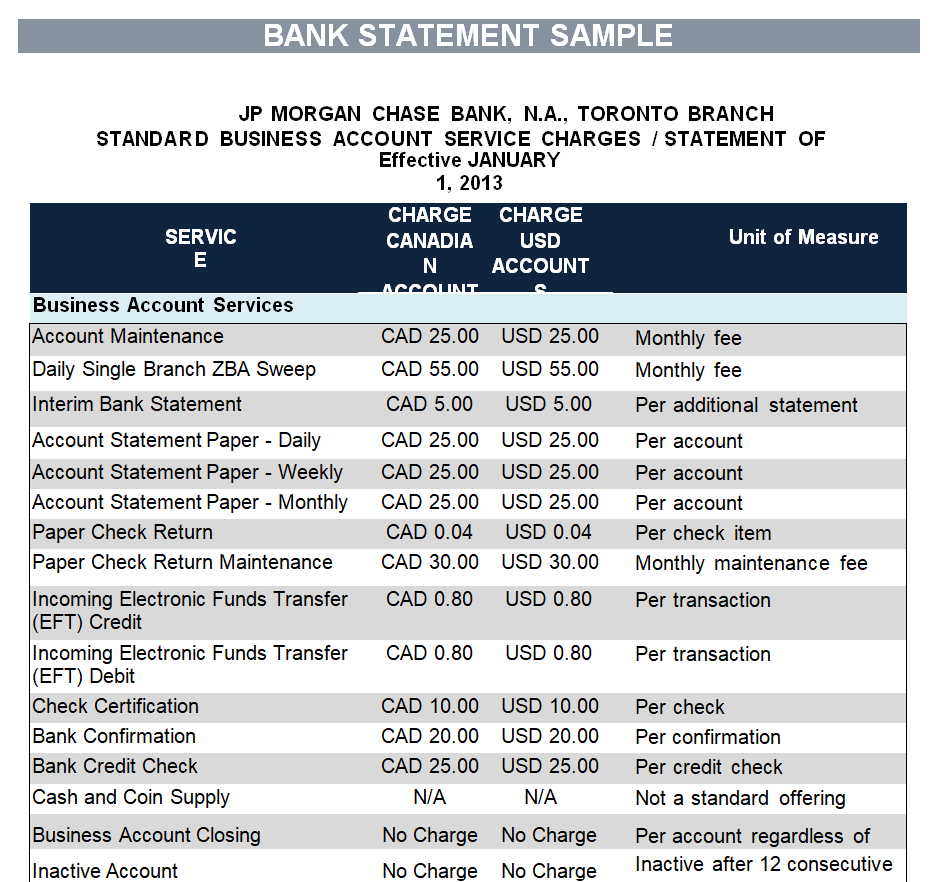

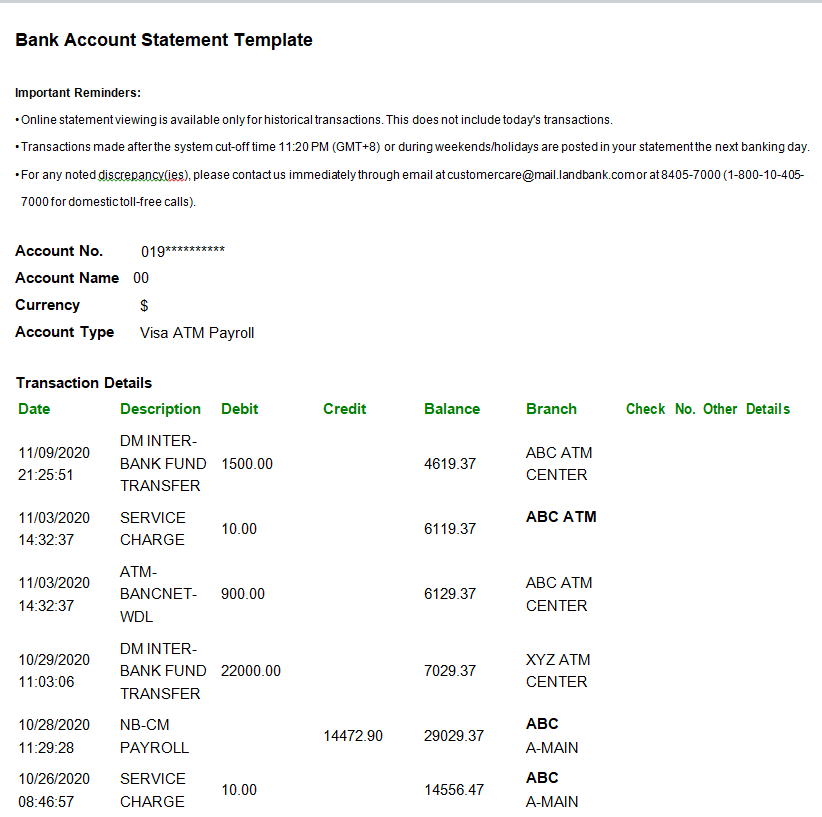

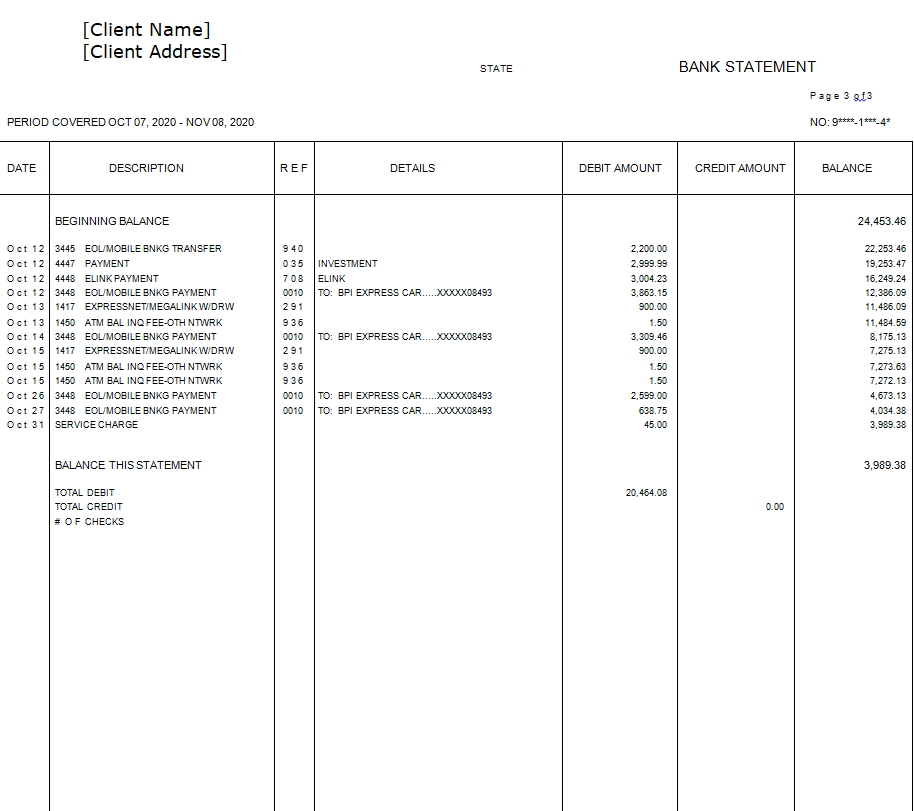

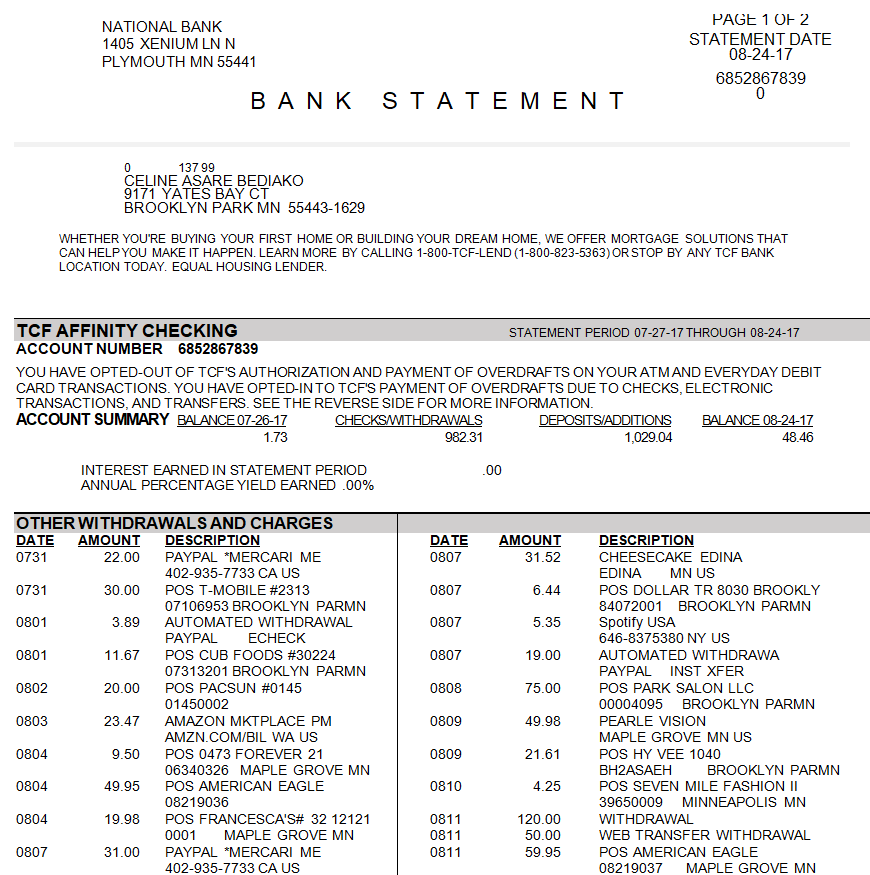

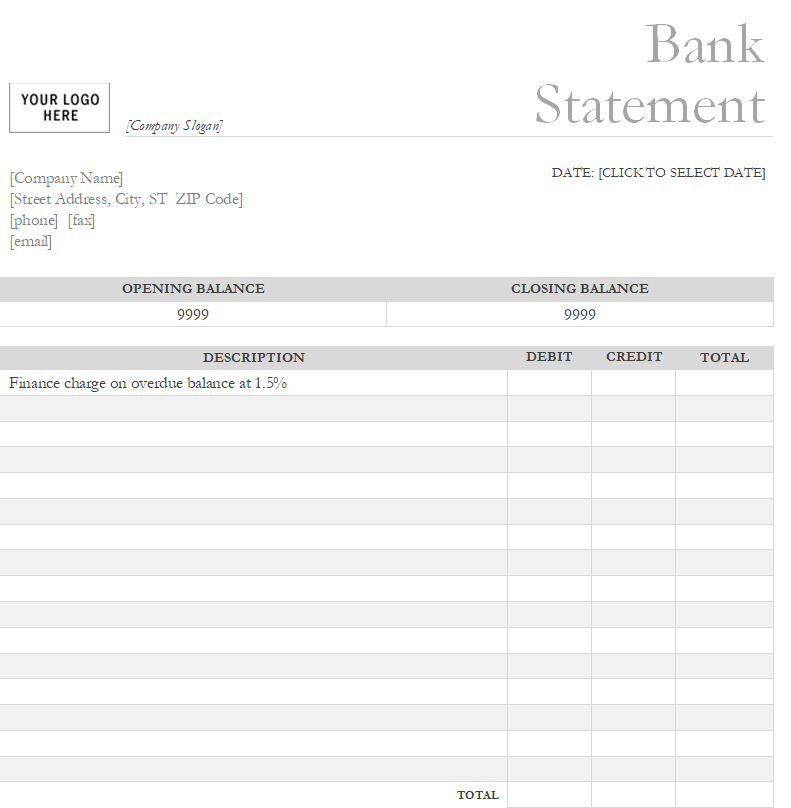

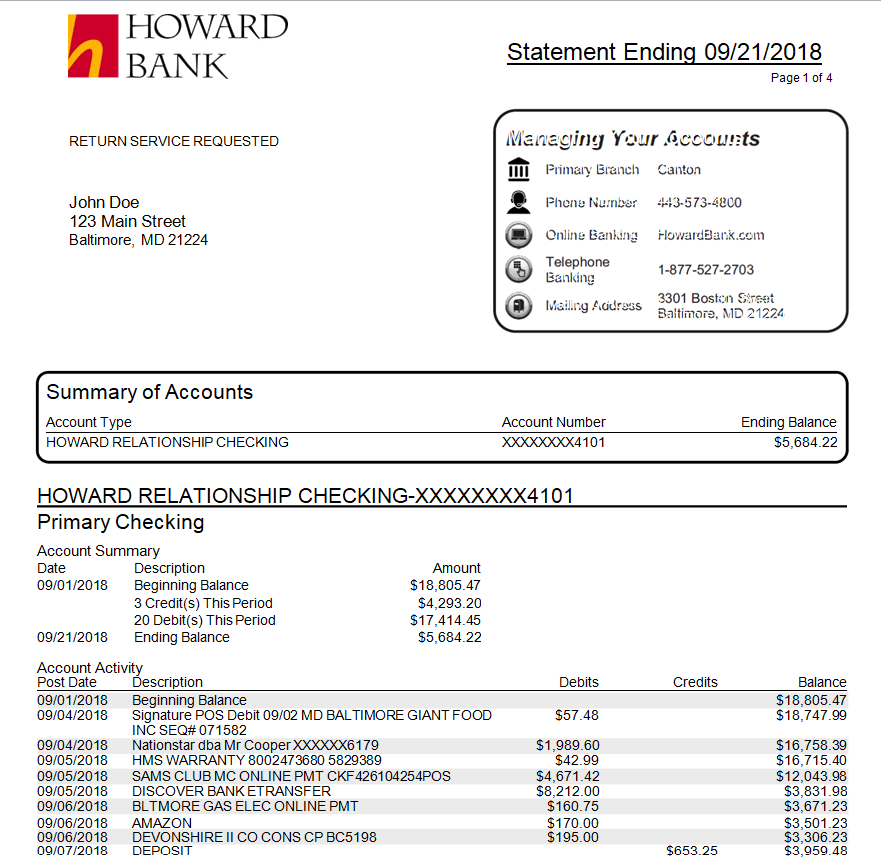

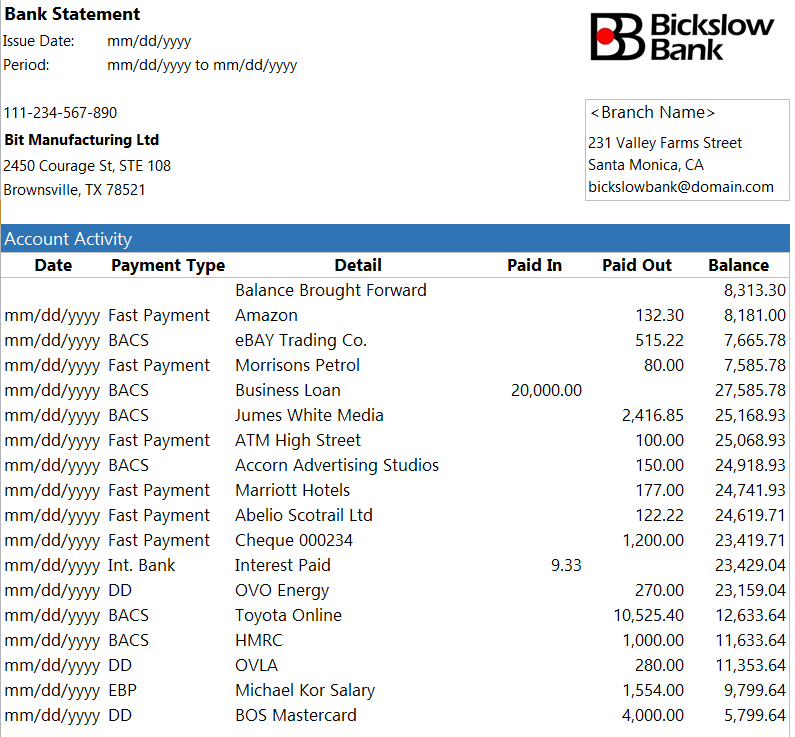

A bank statement usually includes details like the date and a brief description of the transaction, a debit column, a credit column, and the column for the balance amount. Whenever you deposit some amount, the bank credits your account with the same amount and whenever you withdraw some amount, the bank debits your account with the same amount. Basically, a bank statement is the chronological record of all these details and your current account balance for the period is mentioned at the end.

Nowadays, many banks send digital bank statements to their customers via email. You can also get a bank statement from your bank’s official app. However, a bank statement in hard copy is always preferred because it can be used to serve different purposes. The bank must create the bank statement template on its official letterhead. This will make the bank statement authentic and official.

Make sure to scroll down and check out the free bank statement templates available both in Microsoft Word and Excel formats.

FREE Bank Statement Templates WORD

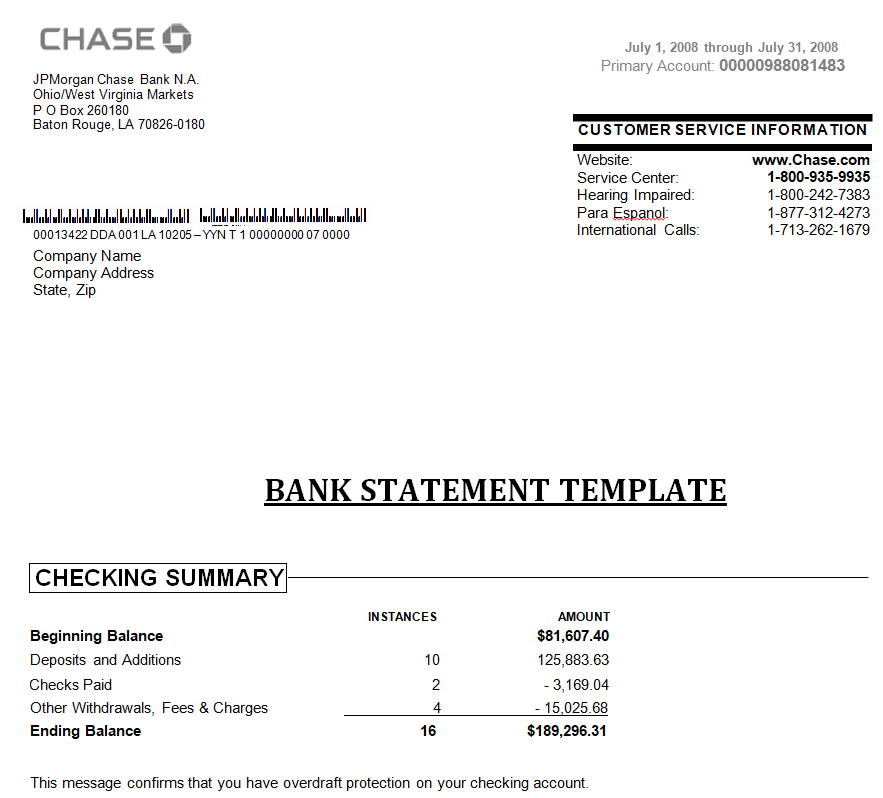

Official Bank Statement Template

File Size: 35 KB

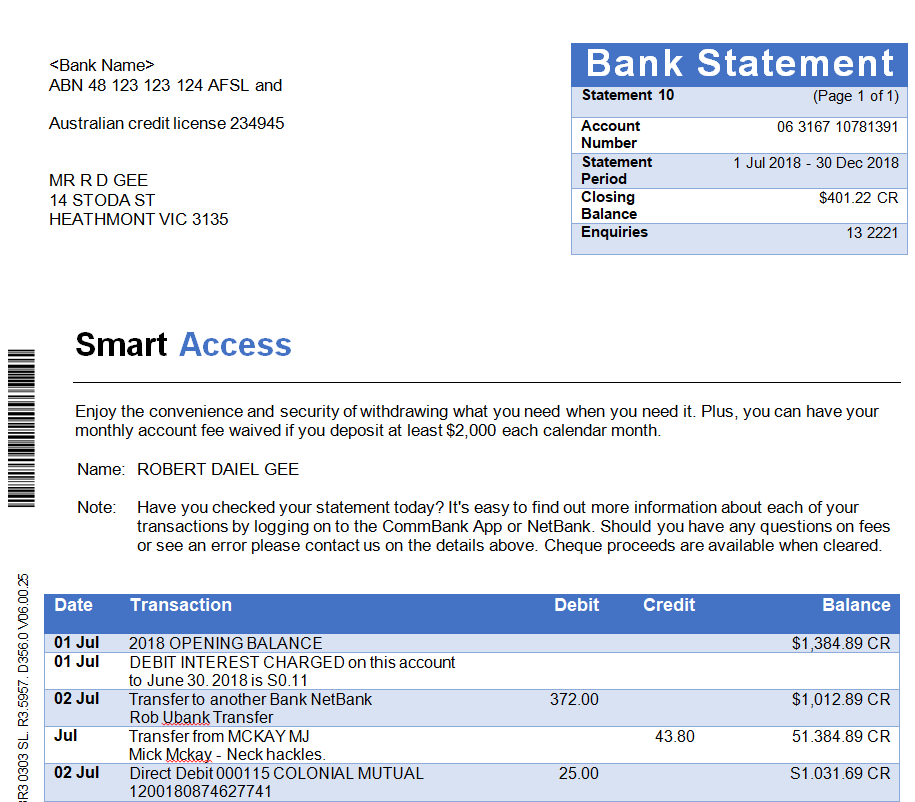

Formal Bank Statement Word Template

File Size: 18 KB

Bank Statement Template Free Download

File Size: 24 KB

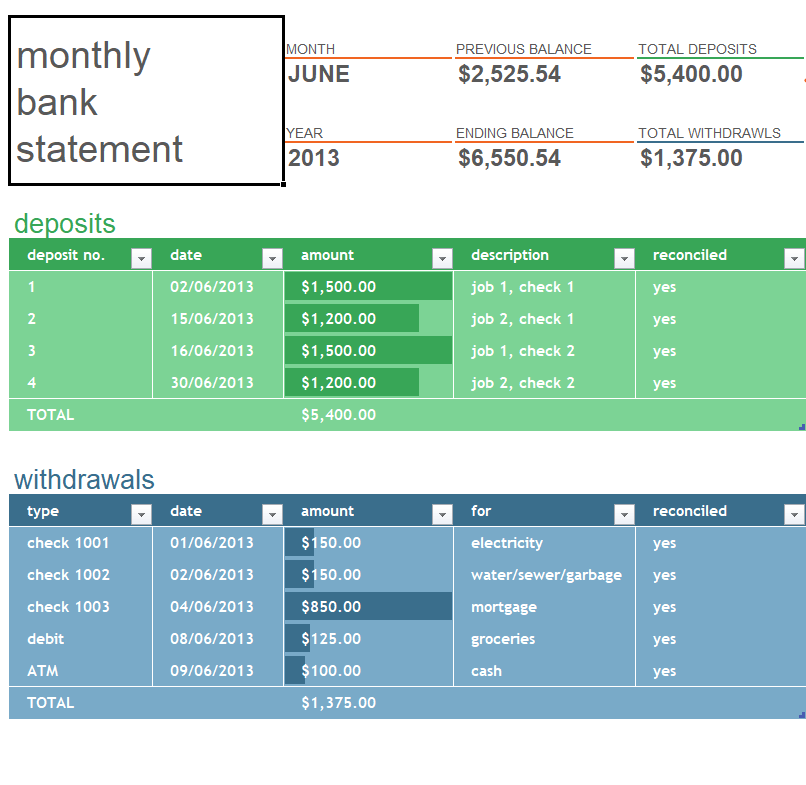

Monthly Bank Statement Excel Template

File Size: 15 KB

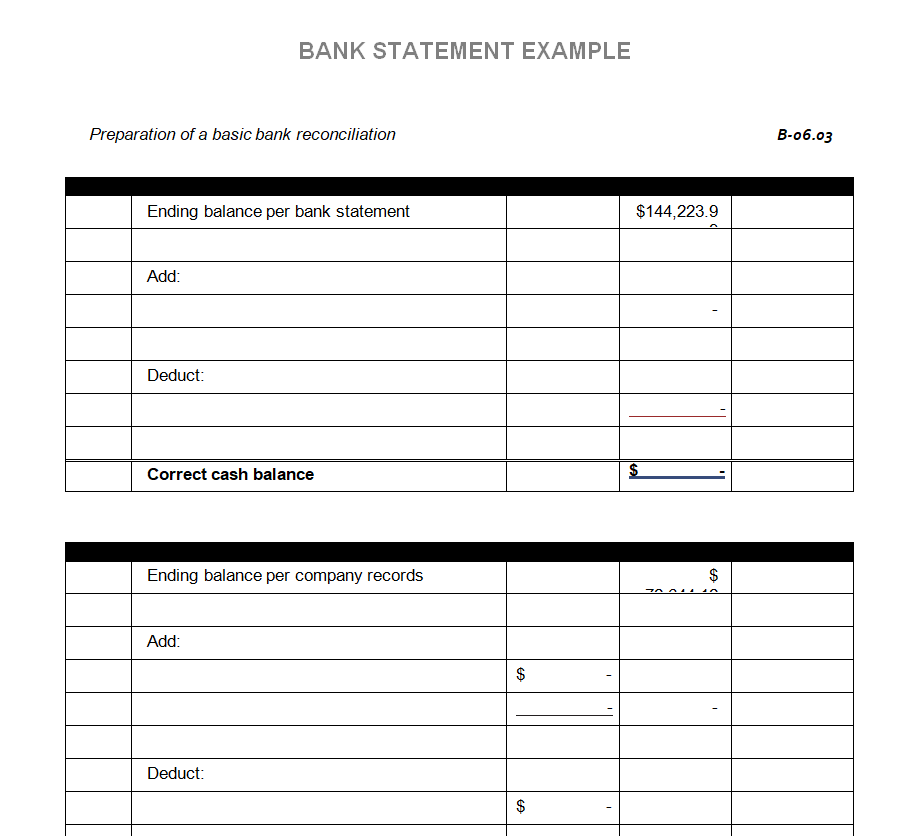

Blank Bank Statement Example

File Size: 16 KB

Sample Bank Statement Template DOC Format

File Size: 11 KB

Professional Bank Statement Template

File Size: 15 KB

Detailed Bank Statement Template in XLSX Format

File Size: 11 KB

Bank Account Statement Template Word

File Size: 24 KB

Standard Bank Statement Template

File Size: 25 KB

Practical Bank Statement Sample Doc

File Size: 28 KB

Free Printable Bank Account Statement Template

File Size: 34 KB

How to Create a Bank Statement Template?

As mentioned earlier, you can use free bank statement templates available here on this page to create a perfect bank statement template. All these templates are available in a customizable format so that you can easily insert your details into a particular template and make it useable for yourself. However, if you want to know how to create a bank statement template from scratch, the following is a list of some of its basic elements:

Letterhead

The bank statement template must be created on the official letterhead of the bank. This makes the bank statement official and authentic.

Header

The header section of the bank statement template should include some important information related to the bank such as:

- Title of the document as: “Bank Statement”

- Bank logo

- Name of the bank

- Address

- Bank branch name, if any

- Contact details of the bank (both branch and the head office)

- Email address

Period or Timeframe:

It is very important to mention the period or timeframe for which the bank statement is issued. Write the start and end date.

Account Holder’s Details:

Whether the account holder is an individual or a business, write some basic personal details of the account holder like:

- Name (individual or business)

- Address

- Contact Number

- Email Address

Details of the Account:

Carefully mention the details of the account in the bank statement template. These details include:

- Account Number

- IBAN

- Account Title

- Type of Account (Current or Savings)

Transaction Details:

Probably the most important part of the bank statement template is the details of the transaction. Always begin with the opening balance and then write the details of all the receipts or deposits and withdrawals of payments in the bank account. The complete activity of the account during the said period must be shown in your bank statement.

As mentioned earlier, every time a customer deposits an amount in the bank, the bank credits the account by the same amount. Similarly, when a customer withdraws an amount from the bank account, the bank debits the account with the same amount. The bank statement must include separate columns for:

- Date

- Brief details of every transaction

- Withdrawals (Debit Column)

- Receipts or Deposits (Credit Column)

- Balance Amount

The bank must ensure that only the transactions related to the set period are included in the bank statement. Also, make sure to write the transactions in chronological order. In modern times, there is no need to be worried about that too much because all the banks use automatic accounting and data entry software and programs. However, it is still good to recheck and review the statement thoroughly before finally issuing it.

Summary:

At the end of the bank statement template, you should include a brief summary of the account. This usually includes the opening balance, a sum of all the receipts or deposits, a sum of all the withdrawals, and a closing balance. The sum of all the receipts or deposits is added to the opening balance and the sum of all the withdrawals is deducted from it to reach the figure of ‘closing balance’. The closing balance indicates the amount that is available to the customer in its account at a certain date.

Best Bank Statement Templates

Free Customizable Bank Statement Template

File Size: 23 KB

Trust Bank’s Customer Statement Template

File Size: 22 KB

Elemental Bank Statement Excel Template

File Size: 14 KB

Bank Statement Sample Free Download

File Size: 22 KB

Special Bank Account Statement Template

File Size: 13 KB

Simple Bank Statement Word Template

File Size: 18 KB

Descriptive Bank Statement Template

File Size: 23 KB

Bank Statement Example Format

File Size: 28 KB

Free Editable Bank Statement Template

File Size: 15 KB

Proper Bank Statement Template in MS WORD

File Size: 153 KB

Excel Bank Statement Template Free Download

File Size: 43 KB

Editable Statement of Account Template Word

File Size: 21 KB