A handy collection of some free statement of account templates is provided here on this page. These statement of account templates will help you easily understand the contents of an account statement. This article includes many important details pertaining to a statement of account such as what it is, its purpose, its main contents, and tips for creating one. So, make sure to scroll down and check all these essential details.

Check the Exclusive Statement of Account Templates Below (WORD & EXCEL)

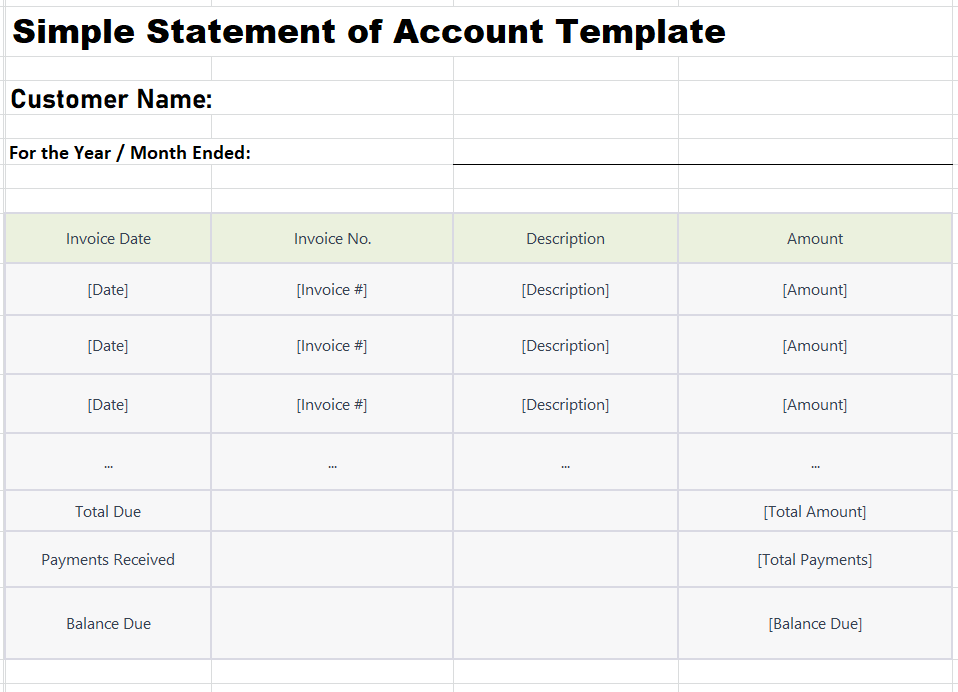

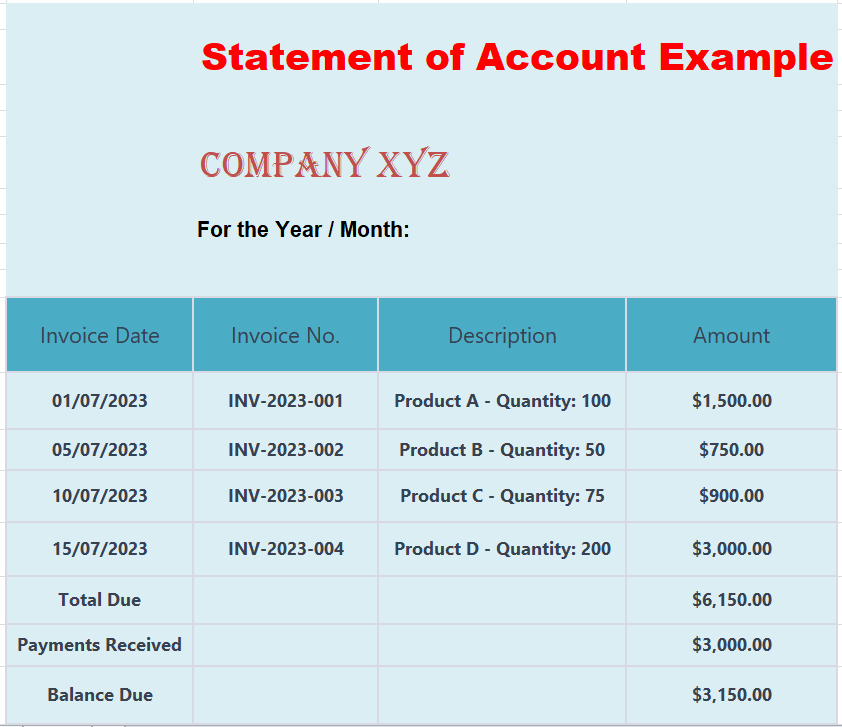

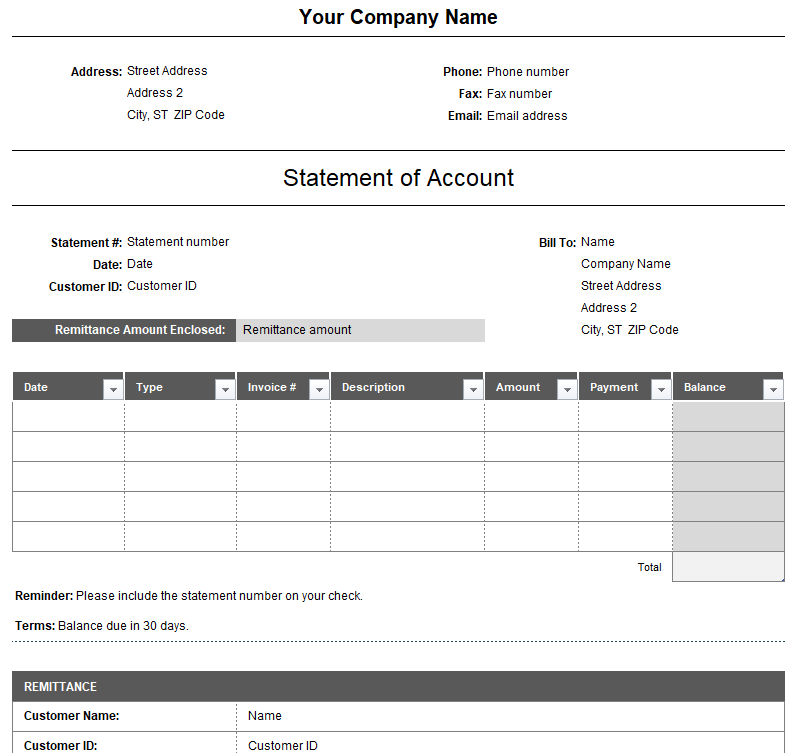

The given below 2 statement of account templates are available both in Microsoft Word and Excel formats so that our users can easily customize these exclusive account statement templates the way they want to. So, once you click the ‘Download’ button for any or both of these exclusive templates, you will get a compressed file and when you extract the file. you will get each of these templates both in Doc and XLSX formats.

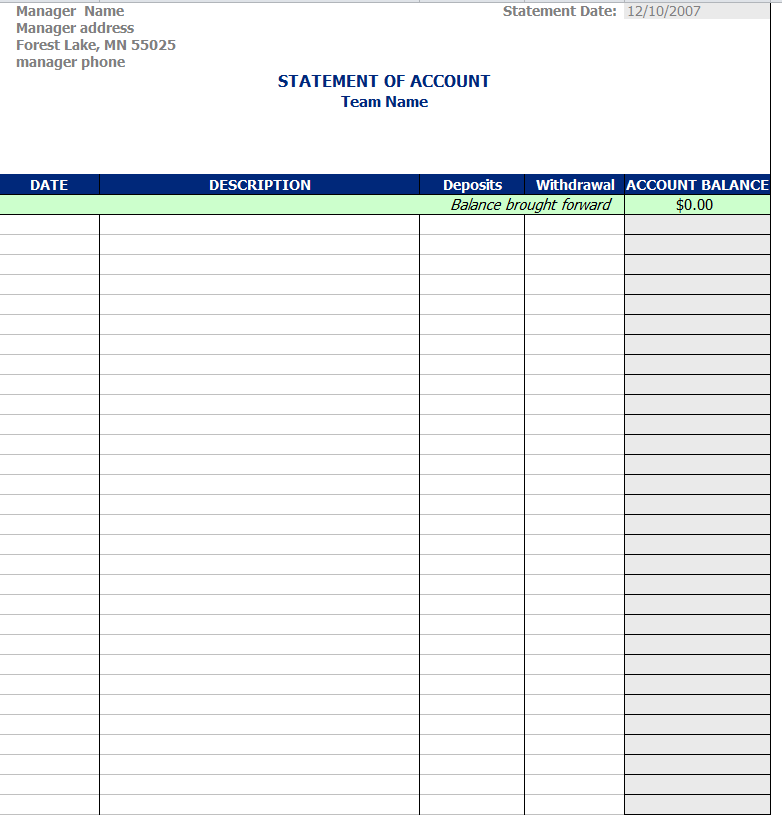

Simple Statement of Account Template

Company’s Statement of Account Example

What is a Statement of Account?

Think of a statement of account as your personal financial snapshot, kind of like a mini financial report. It’s like a friendly reminder from your bank, credit card company, or any other business you have an account with, telling you, “Hey, here’s what’s been happening in your account recently!” It’s all about keeping you in the loop and making sure you’re aware of your financial activities.

You know how you might keep a record of your expenses and earnings in a little notebook to keep things organized? Well, a statement of account is just like that, but way more official and professionally prepared by the folks handling your money.

So, what’s inside this magical piece of paper? Well, let me tell you! It typically shows all the transactions related to your account during a specific period, usually covering a month. You’ll find details about any deposits, withdrawals, purchases, payments, and even any fees that have been charged.

The statement of account is like a detective’s magnifying glass for your finances. It allows you to double-check that everything adds up nicely and that there aren’t any sneaky charges or mysterious withdrawals you didn’t expect. It’s all about transparency and making sure you and the company are on the same page.

And you know what’s great? It’s not just one-way communication! If you spot something fishy or have any questions, you can simply get in touch with the company’s customer service team, and they’ll be more than happy to assist you. They want to make sure you’re satisfied, and they’re more than willing to clear up any confusion.

One more thing, don’t let that statement of account sit around collecting dust! It’s a good habit to take a look at it regularly, just to keep tabs on your financial health. You wouldn’t want any surprises down the road, would you?

So, you can say that a statement of account is like a friendly financial update from your favorite companies, making sure you’re well-informed and keeping your financial life running smoothly.

Professional Statement of Account Templates in Excel

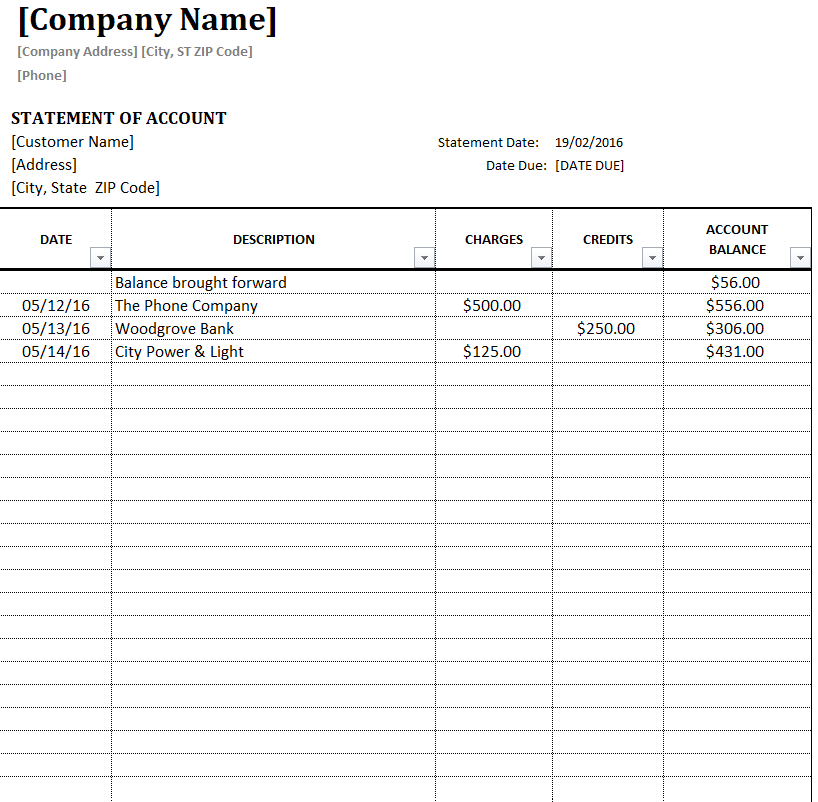

Company’s Statement of Account Template

File Size: 12 KB

Simple Statement of Account Excel Template

File Size: 06 KB

Formal Statement of Account Template

File Size: 14 KB

Corporate Statement of Account Template

File Size: 22 KB

Monthly Statement of Account Template Excel

File Size: 11 KB

Blank Statement of Account Format Excel

File Size: 06 KB

Elemental Statement of Account Template

File Size: 132 KB

Business Statement of Account Template MS EXCEL

File Size: 14 KB

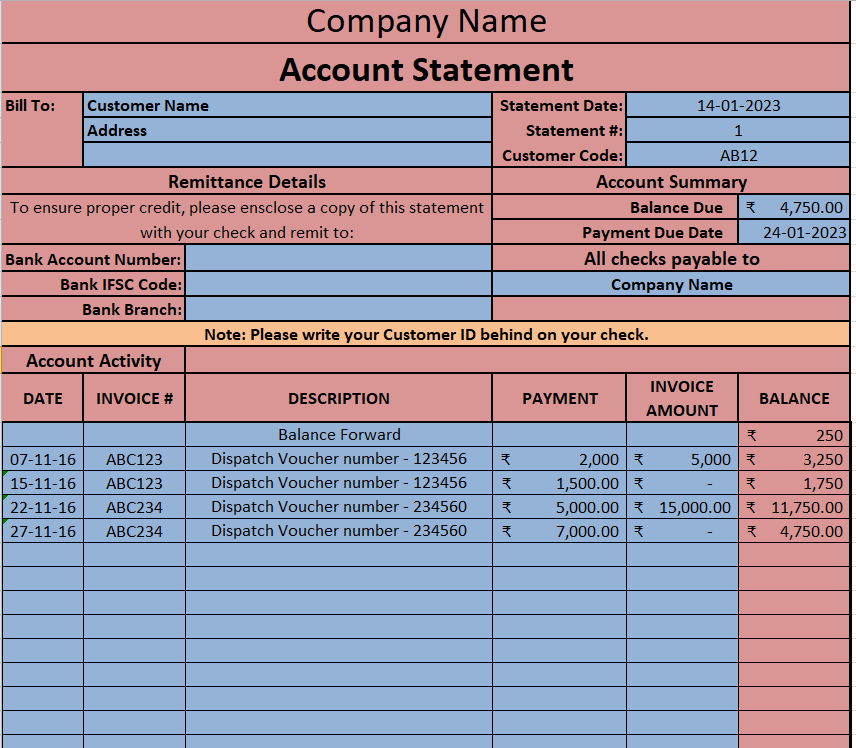

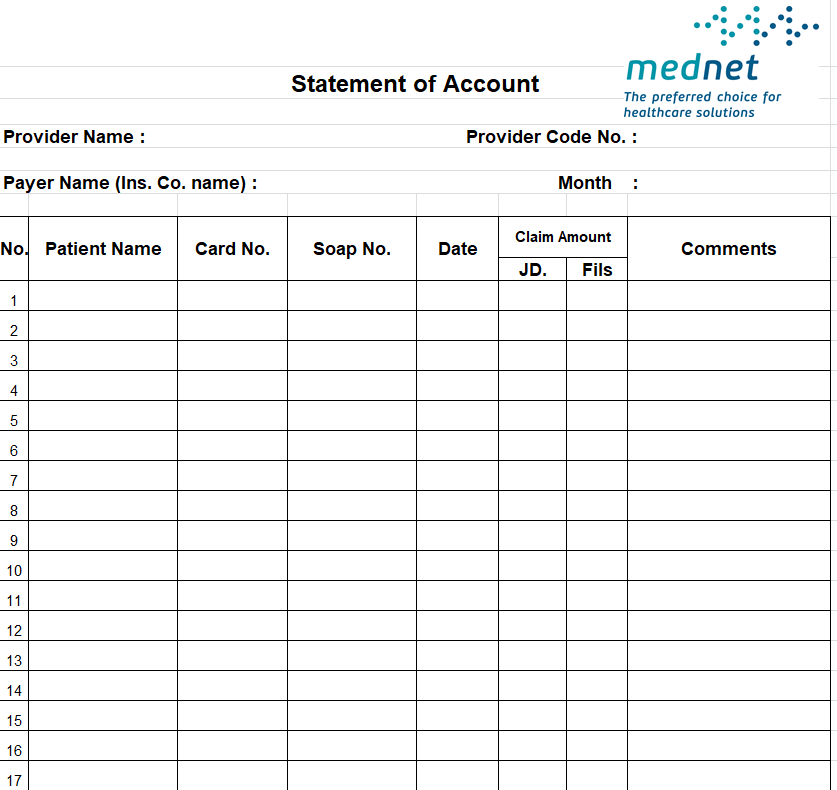

Company’s Fillable Statement of Account Template

File Size: 18 KB

Statement of Account Example Worksheet

File Size: 12 KB

Customer Statement of Account Template Excel

File Size: 15 KB

What is the Cardholder Statement of Account?

The cardholder statement of account also known as the credit card statement or the billing statement, is like a friendly letter from your credit card company or bank, giving you all the juicy details about your card activity for a specific period, usually a month.

First up, the “Account Summary” section gives you a bird’s-eye view of your credit card life. You’ll find your outstanding balance, how much credit you have left to spend, and the minimum payment you need to make to keep the party going smoothly.

Now, let’s dive into the “Transaction History.” It’s like a storybook of your card adventures! Each transaction is listed here, starring the date, the cool place you visited (or the boring bills you paid), and the amount you spent. Keep an eye on this section to make sure everything looks perfect.

Next, we have the “Payments and Credits” part. It’s all about the money, honey! Here, you’ll see the payments you made (gold star for responsible money management) and any credits you received, like refunds or rewards that bring smiles to your face.

Ah, “Interest and Fees” — the villain of the story if you carry a balance from one month to another. If that’s the case, this section shows the interest that sneaked its way onto your outstanding balance. Plus, any annoying fees that might’ve popped up, like those occasional late payment fees or the not-so-fun annual fees.

Now, pay attention to the “Due Date and Minimum Payment” zone. Mark your calendar with a big heart around the due date, as it’s when you need to pay up. Remember, paying the minimum is like giving your credit card a little hug, but paying the full amount is the superhero move to dodge those interest charges!

And let’s not forget the “Rewards Summary,” the little treasure trove for the savvy shoppers out there. If your credit card is a rewards champ, this section tells you about all the goodies you’ve earned during the billing cycle. Treat yourself!

Last but not least, keep an eye on the “Important Notices and Messages” part. It’s like the postscript in a letter. Sometimes, your credit card company has something important to tell you about your account or some exciting changes they want to share. Stay informed, my friend!

Remember, it’s essential to give your statement some TLC every month. Double-check for any unexpected surprises or mysterious charges that don’t belong to you. If you spot anything fishy, don’t wait! Report it to your credit card company so that they can start taking steps to resolve any issues or discrepancies.

FREE Statement of Account Word Templates

Statement of Account Template Word

File Size: 04 KB

Rental Statement of Account Template

File Size: 09 KB

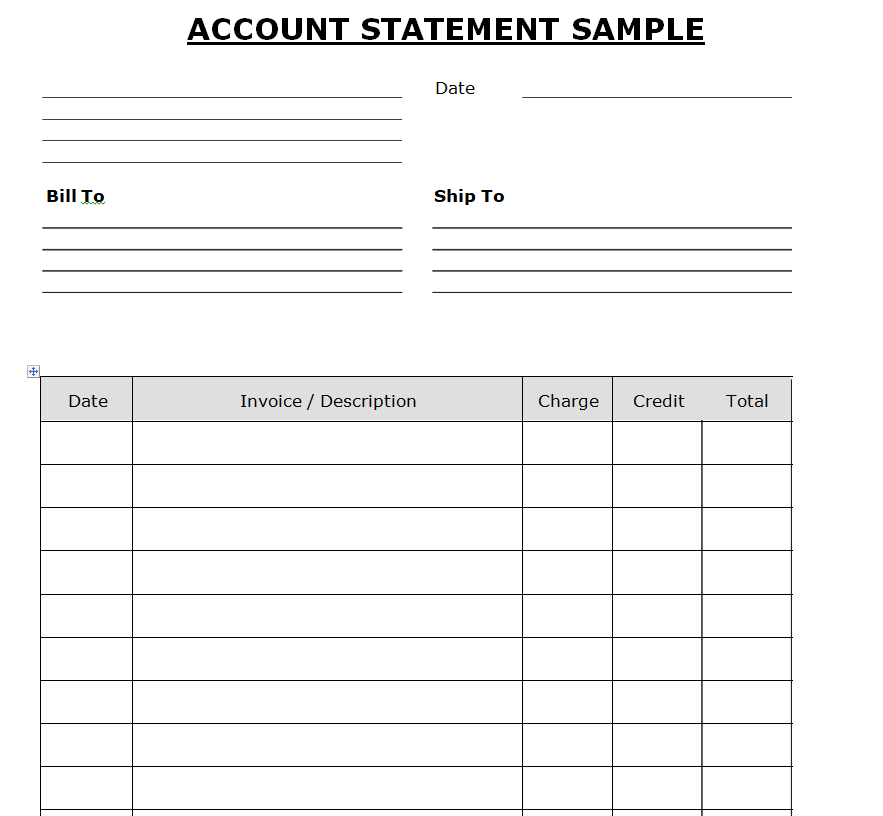

Sample Statement of Account Template

File Size: 10 KB

Printable Account Statement Sample DOC

File Size: 08 KB

Statement of Account Template Singapore

File Size: 10 KB

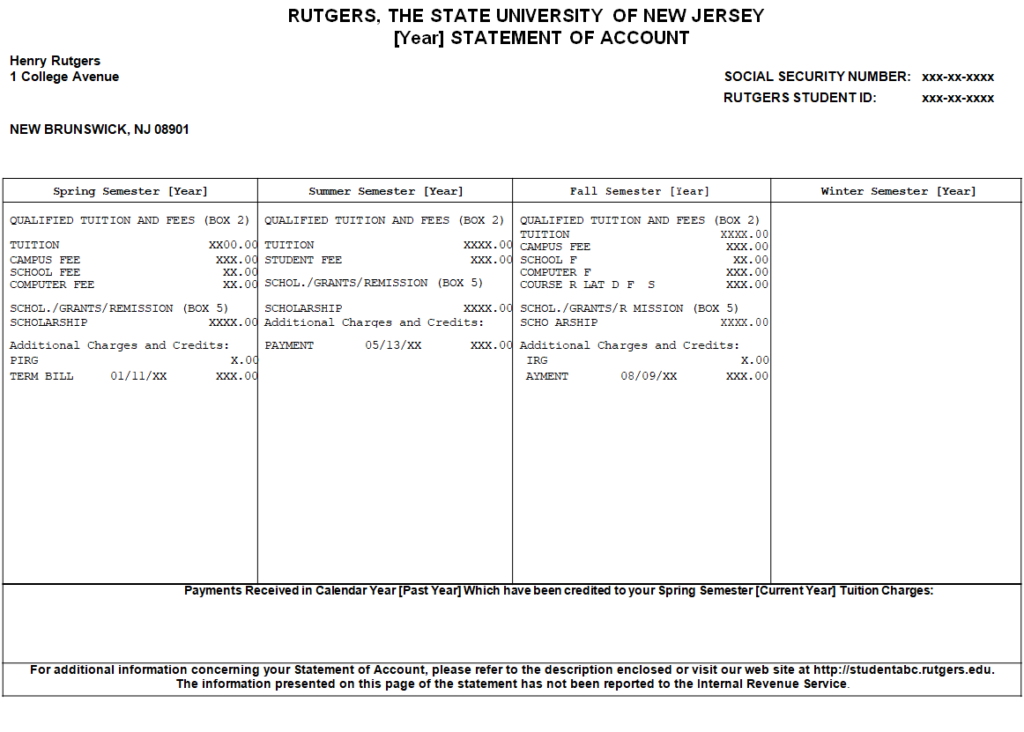

University’s Statement of Account Template

File Size: 05 KB

How Statement of Account Templates Actually Help?

As an entrepreneur, staying organized and managing financial records efficiently is crucial for the success of my business. One tool that has significantly helped me in this regard is using premade Statement of Account Templates. In this article, I’ll share my personal experience with these templates and explain how they can be beneficial for other entrepreneurs as well.

Streamline Record-Keeping:

Before integrating Statement of Account templates into my business, I struggled with manual record-keeping, which was time-consuming and prone to errors. However, using these templates revolutionized the way I managed financial data. By filling in the necessary information in the pre-designed sections, I quickly generated organized and professional-looking SOAs, saving me precious time and energy.

Enhance Professionalism:

A well-structured and visually appealing Statement of Account conveys professionalism and competence to clients. These templates offer a standardized format, allowing you to present financial information in a clear and concise manner. With my clients impressed by the clarity and accuracy of the statements, I noticed an improvement in client trust and satisfaction, which, in turn, positively impacted my business reputation.

Monitor Outstanding Payments:

For any entrepreneur, tracking outstanding payments is vital to maintain a healthy cash flow. Statement of Account templates made this task significantly more manageable. With all the payment details compiled in one place, I could easily identify overdue invoices and promptly follow up with clients. This helped in accelerating payment collections and reducing the risk of bad debt, ultimately improving my business’s financial stability.

Efficient Communication:

Clear communication is the backbone of any successful business relationship. Statement of Account templates provides a standardized platform to communicate financial information effectively. By sharing these statements with my clients, I ensured that they had a comprehensive overview of their transactions with my business, eliminating any confusion or disputes.

Bottom Line

In conclusion, utilizing Statement of Account templates has been a game-changer for my business. From streamlining record-keeping and enhancing professionalism to facilitating efficient communication and monitoring outstanding payments, these templates offer numerous benefits that can significantly improve an entrepreneur’s financial management process. So, if you’re looking to simplify your financial records and maintain a professional image with your clients, consider adopting premade Statement of Account templates – they are an invaluable tool for entrepreneurs of all industries.