An organization, irrespective of its size and nature of business, can not operate effectively without its human resource i.e., the employees or workers of the organization. For their efforts and hard work, these employees are paid, usually on a monthly basis. The total sum of payments to all employees is a proper cost of a business which is known as a payroll cost. In order to estimate payroll costs, an organization makes use of payroll reports. In this article, we have got a useful collection of payroll report templates for you right here on this page. All these templates are easily editable so one can create a payroll report sample for its own use.

Check Out the Payroll Report Templates in WORD

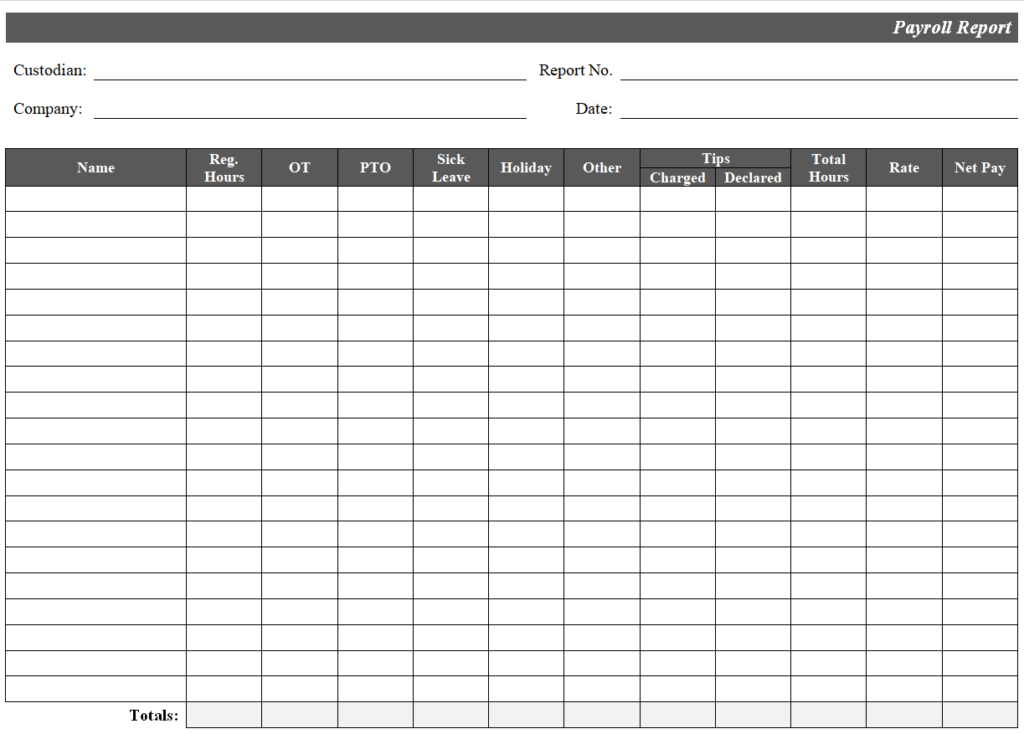

Blank Payroll Report Template

File Size: 07 KB

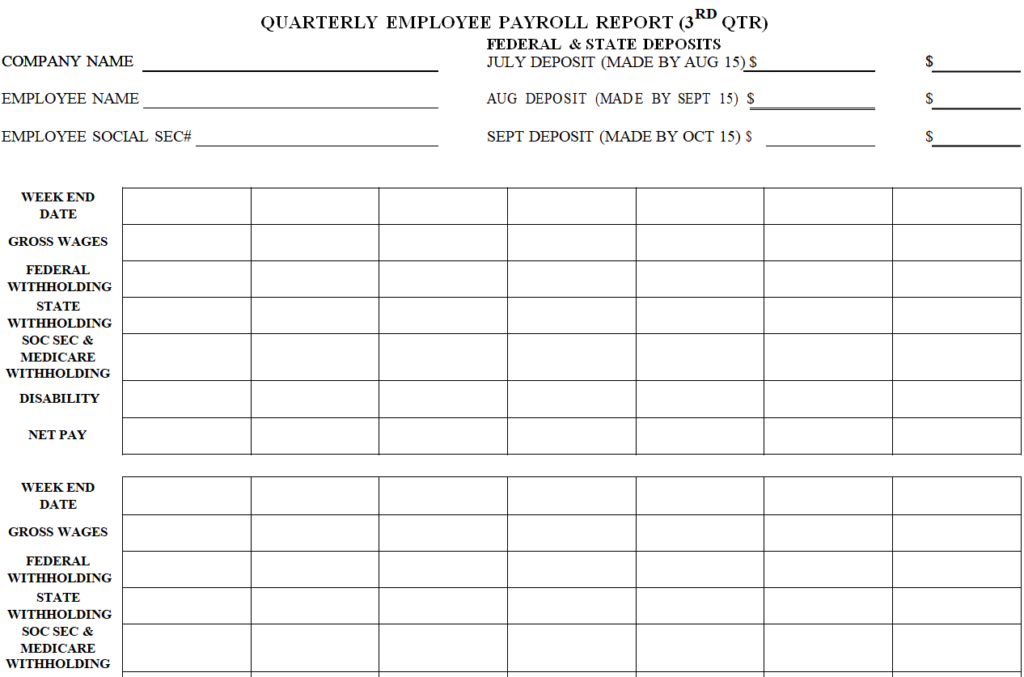

Quarterly Employee Payroll Report Template

File Size: 04 KB

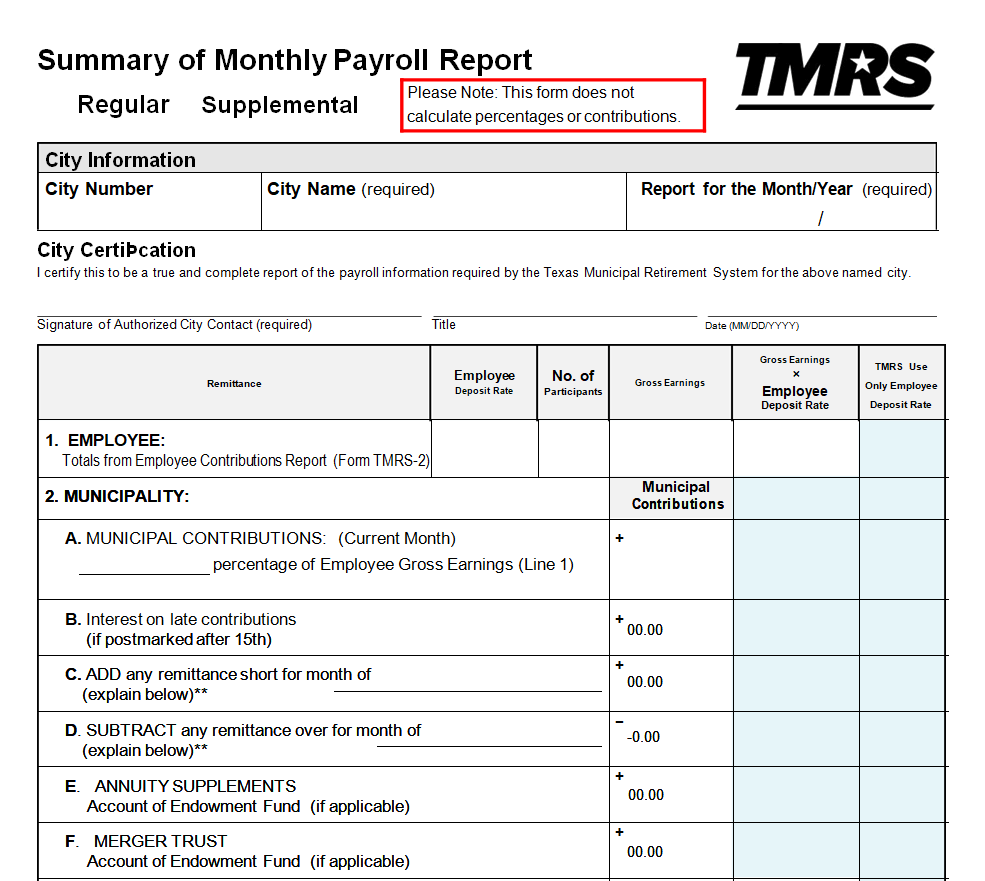

Monthly Payroll Summary Report Sample

File Size: 19 KB

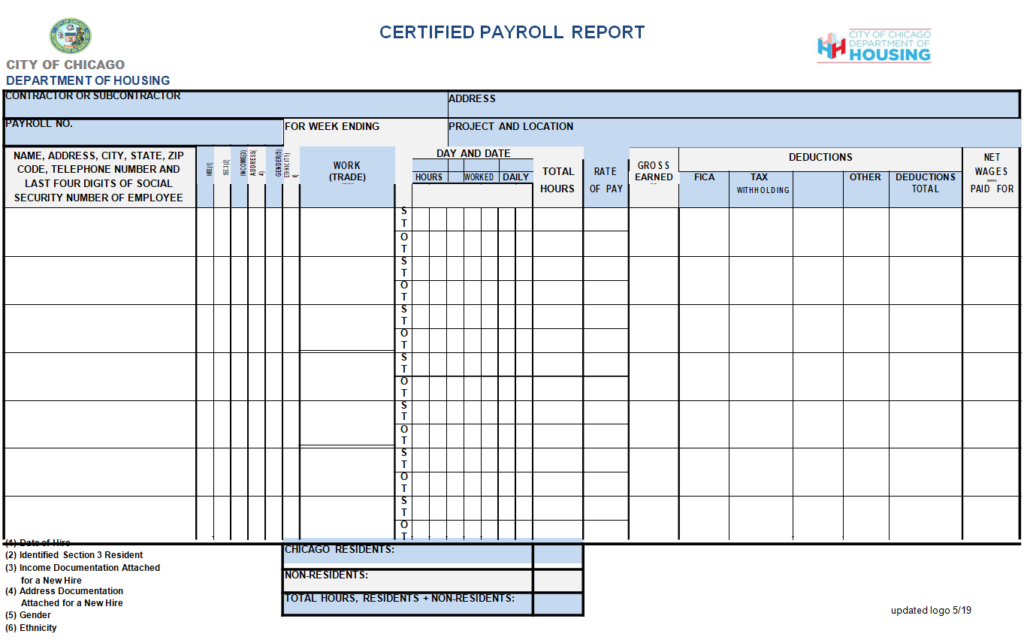

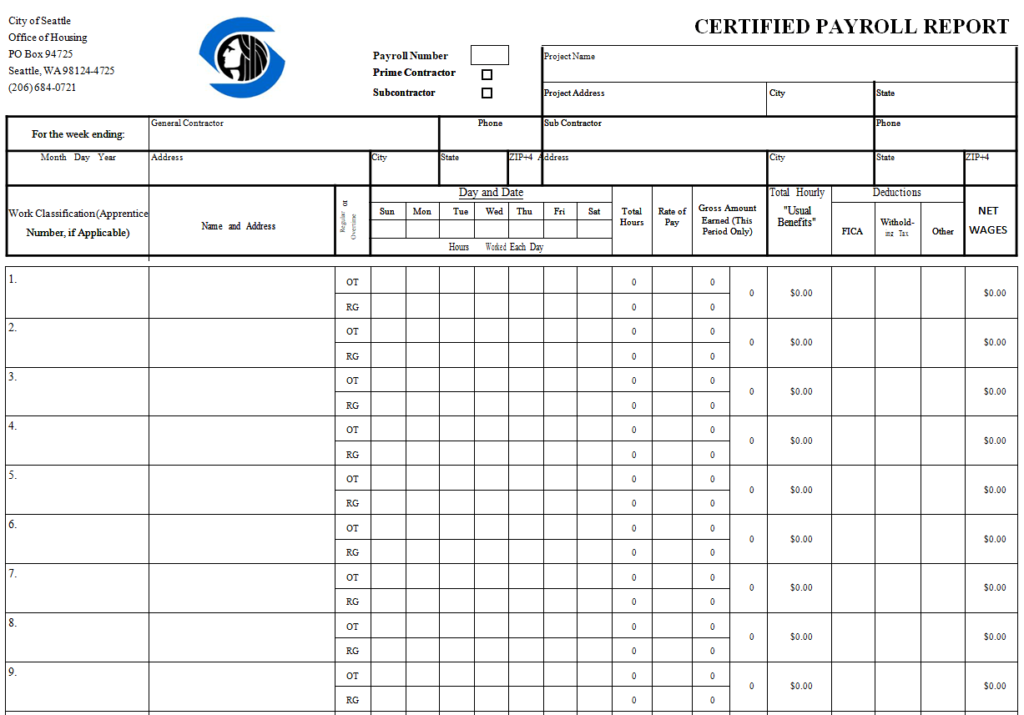

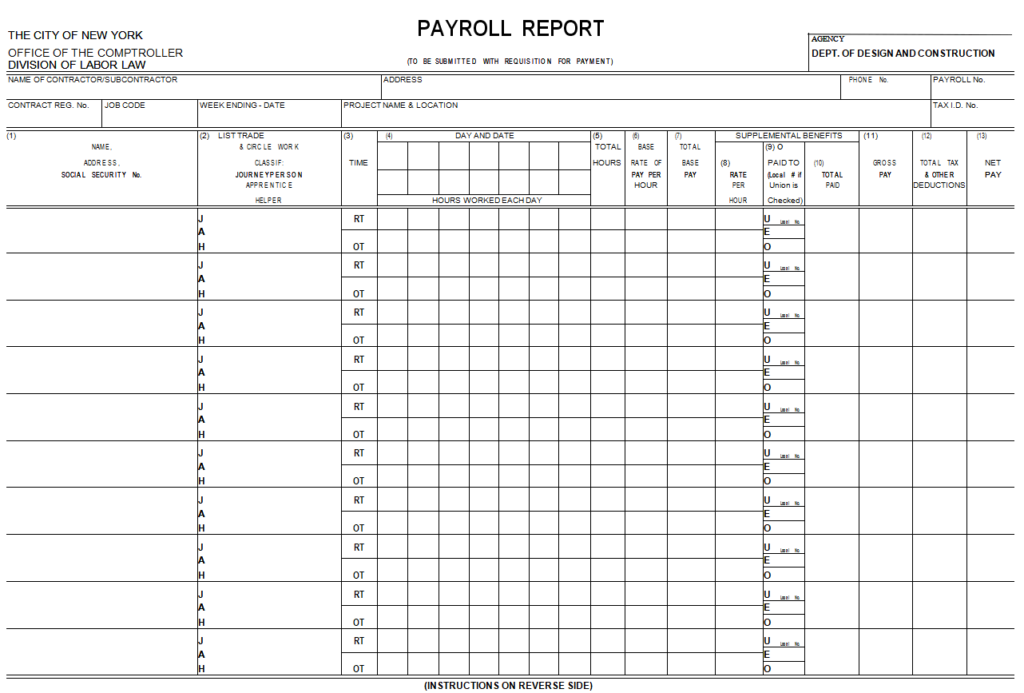

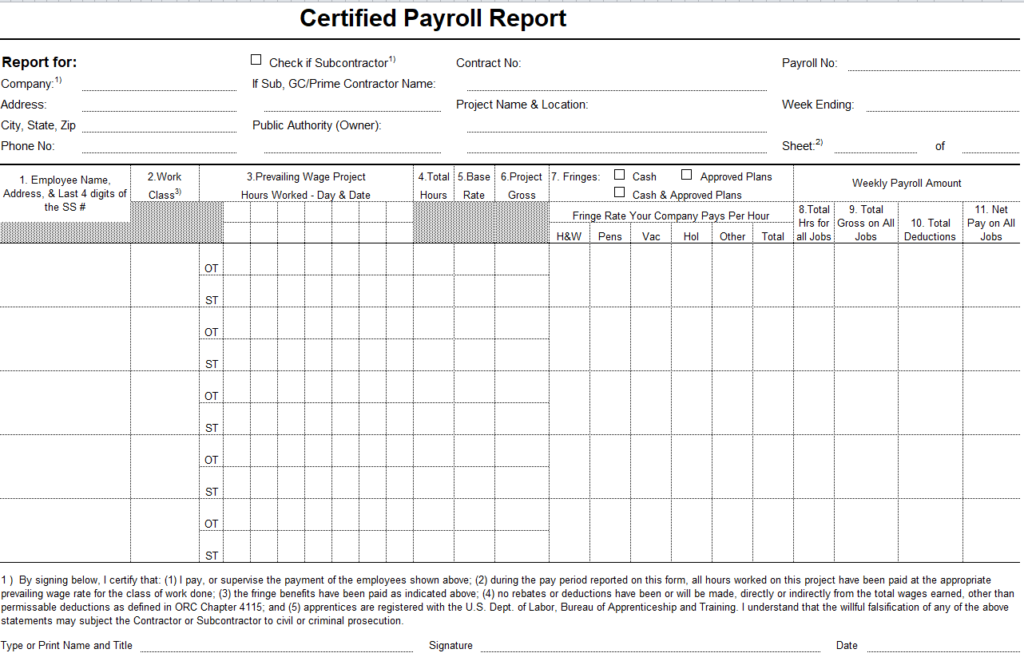

Certified Payroll Report Word Template

File Size: 24 KB

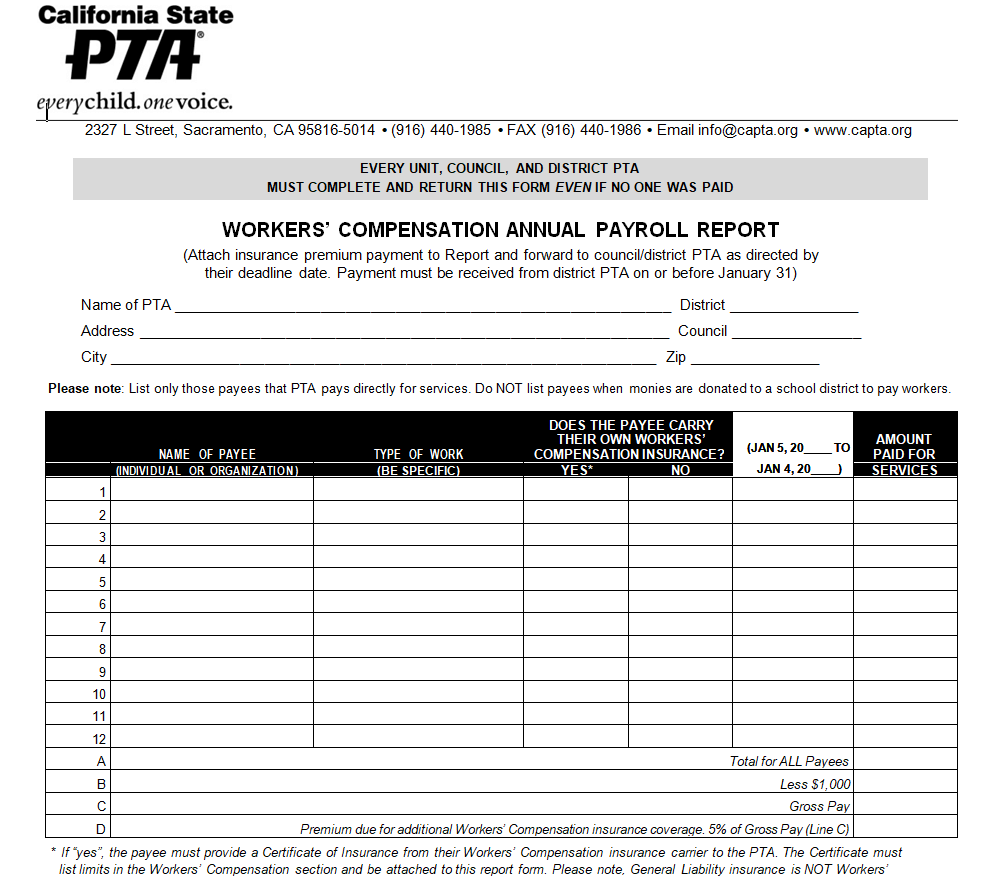

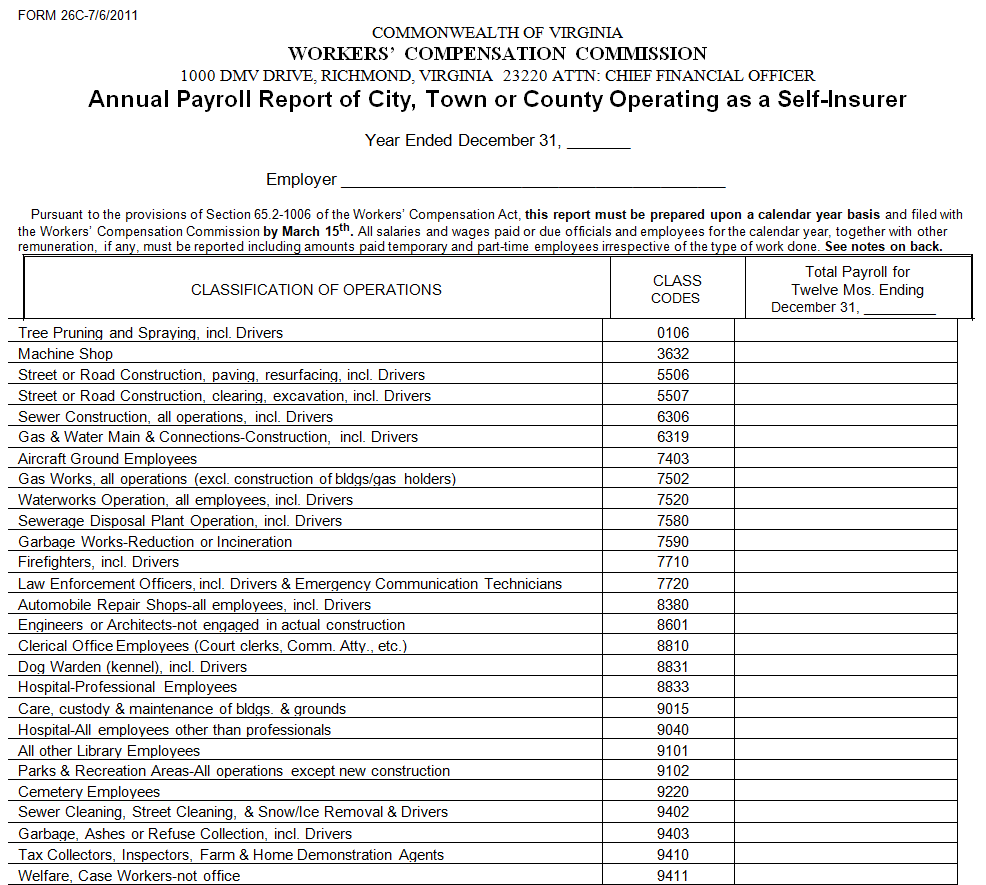

Workers’ Annual Payroll Report Template

File Size: 44 KB

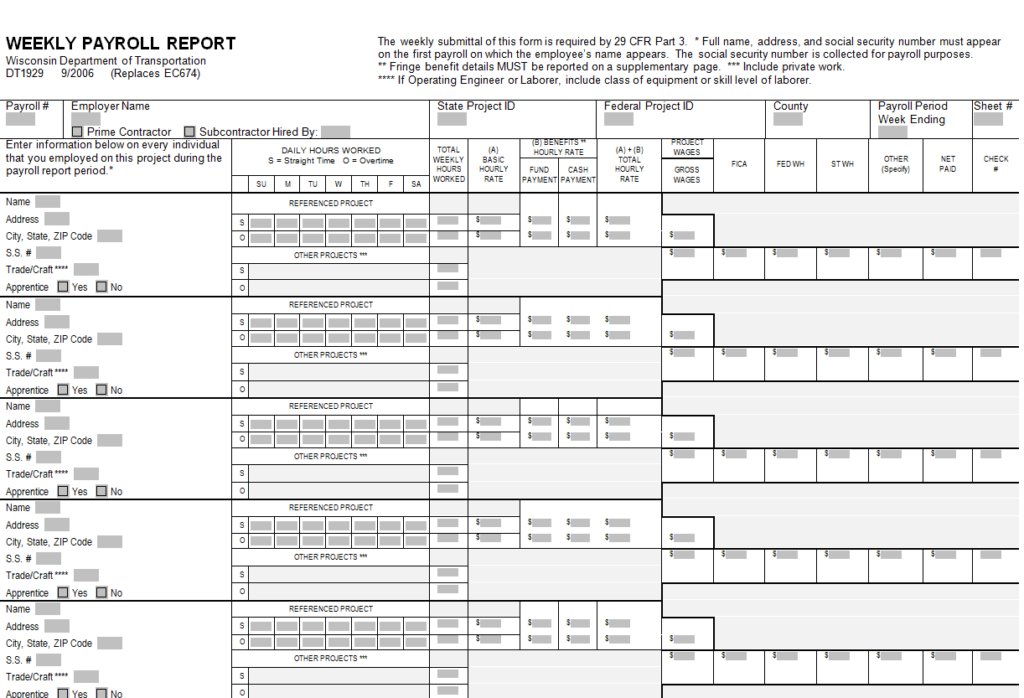

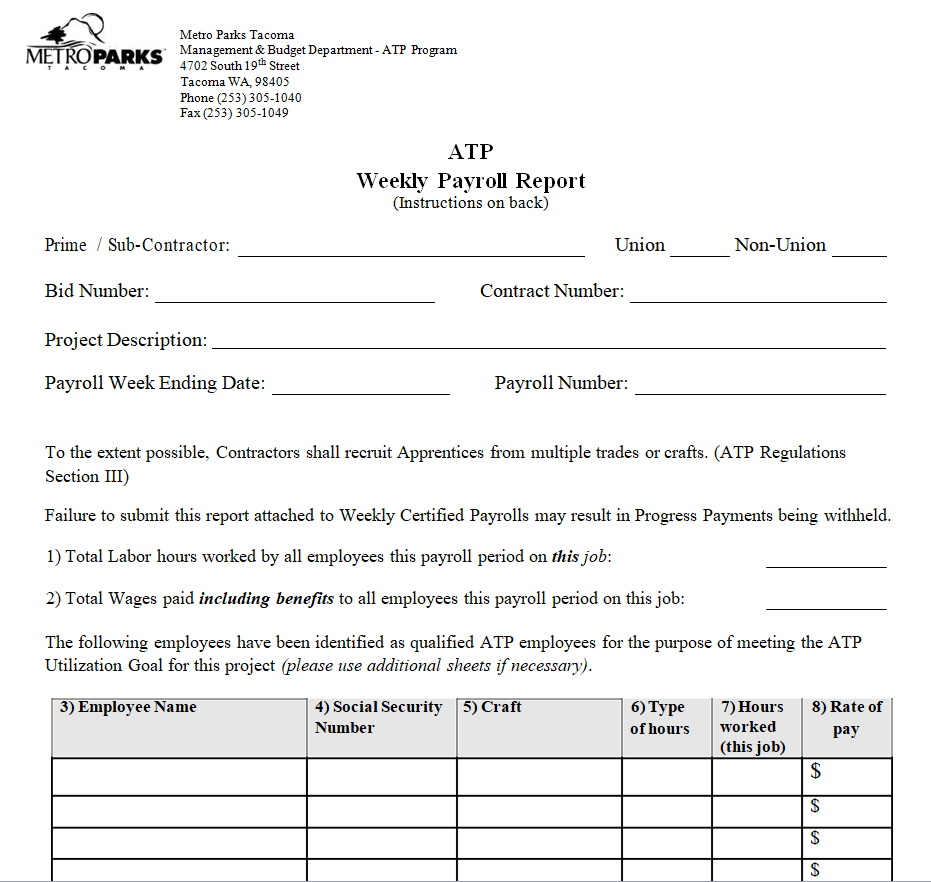

Weekly Payroll Report Example

File Size: 23 KB

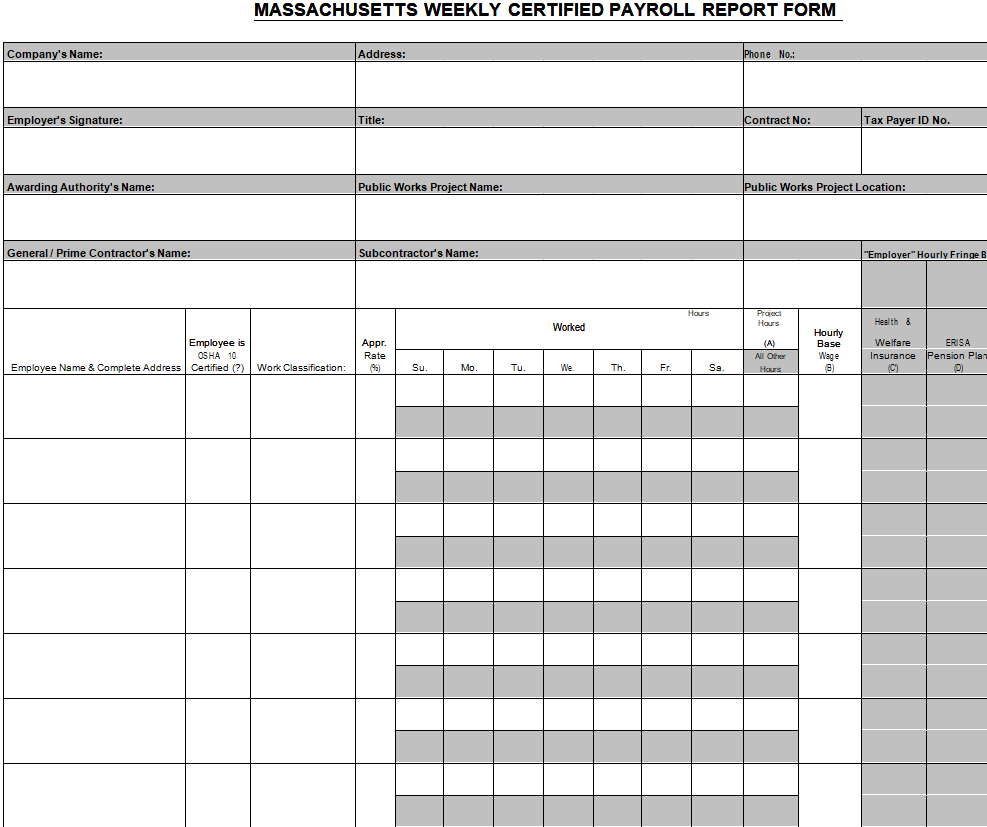

Certified Payroll Report Form Template

File Size: 16 KB

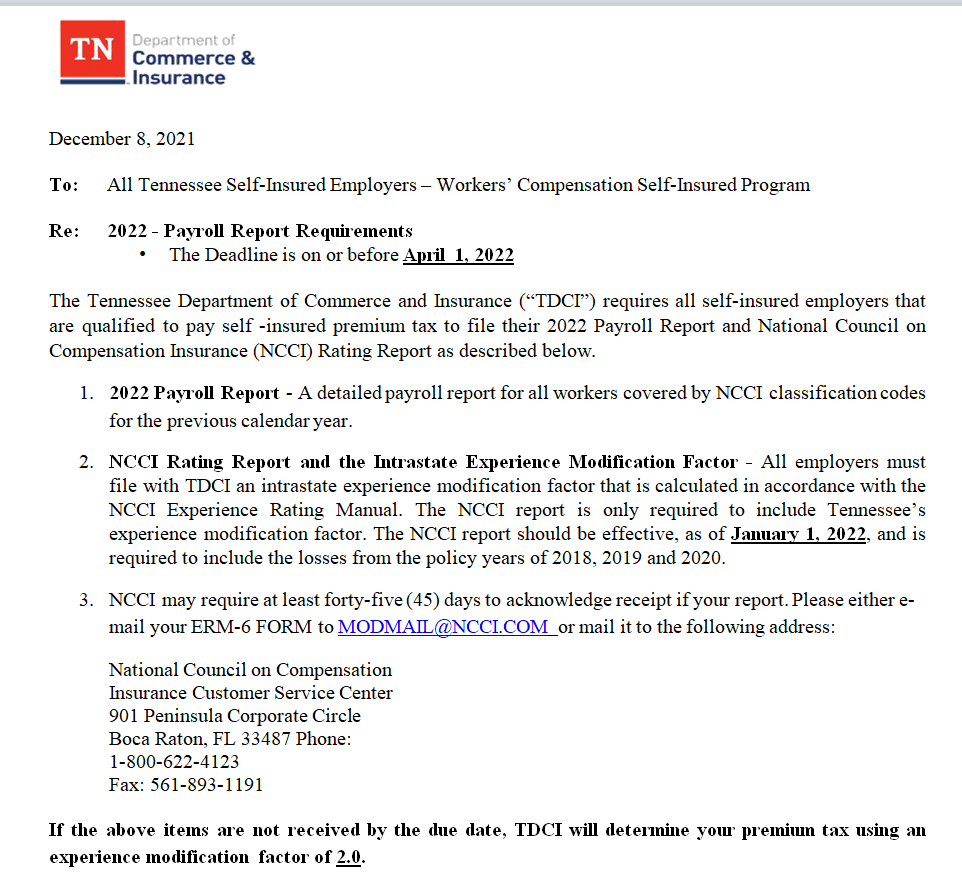

Payroll Report Instructions Template

File Size: 41 KB

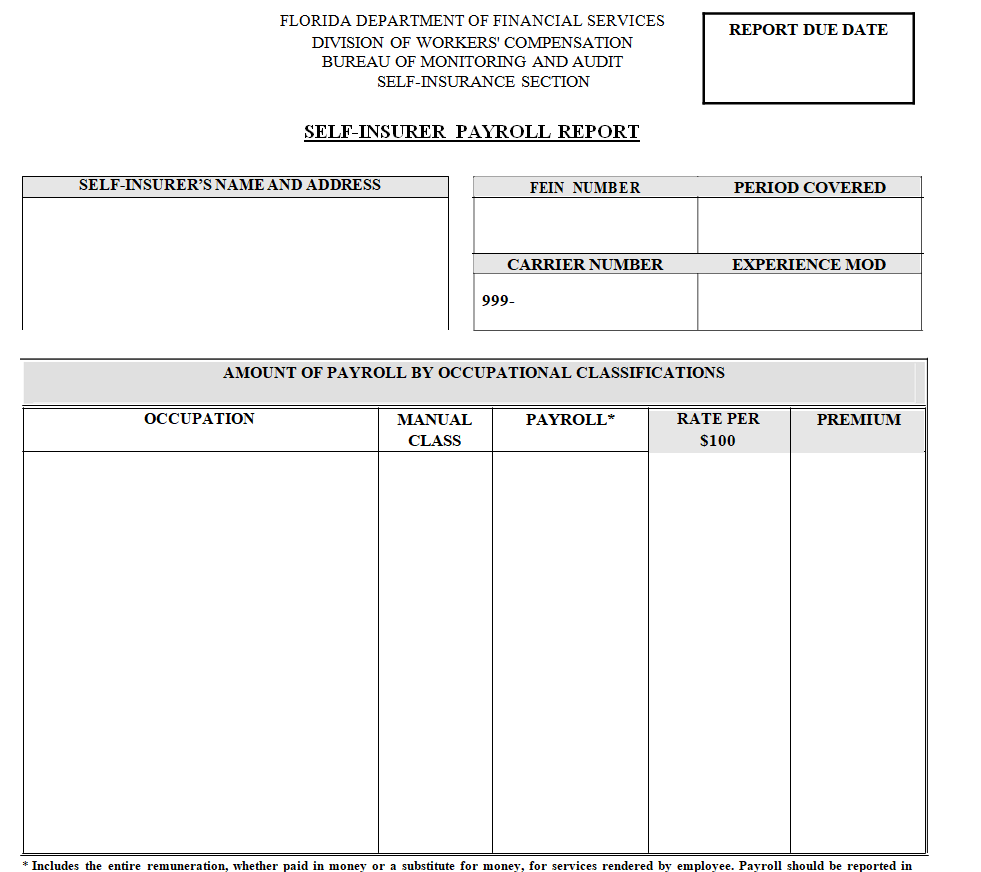

Self-Insurer Payroll Report Template in MS WORD

File Size: 08 KB

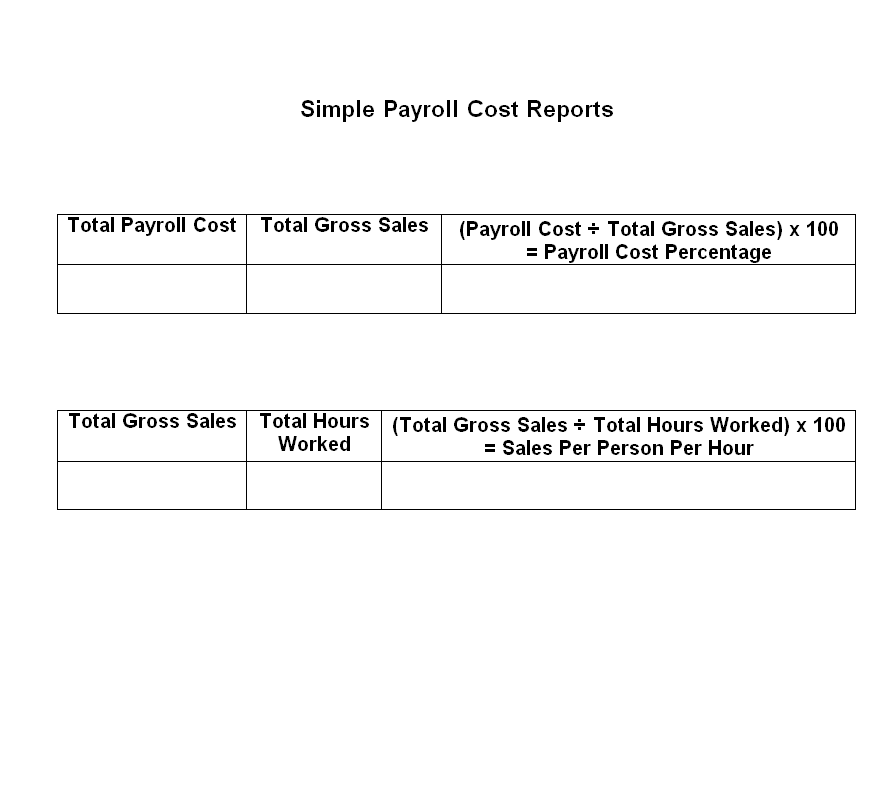

Simple Payroll Cost Report Template

File Size: 05 KB

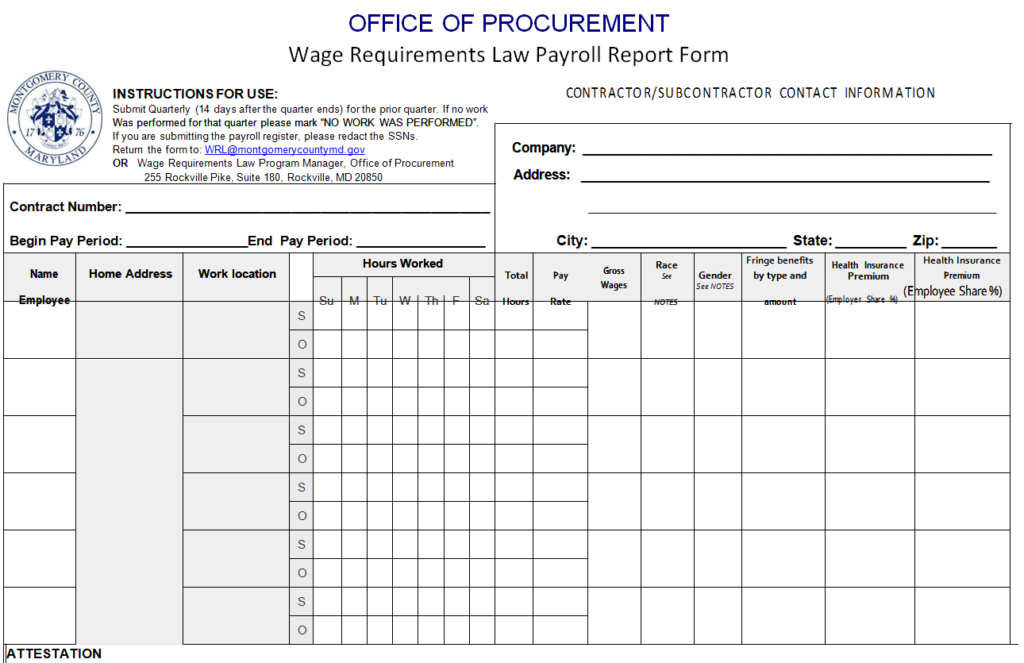

Payroll Report Form Sample DOC

File Size: 22 KB

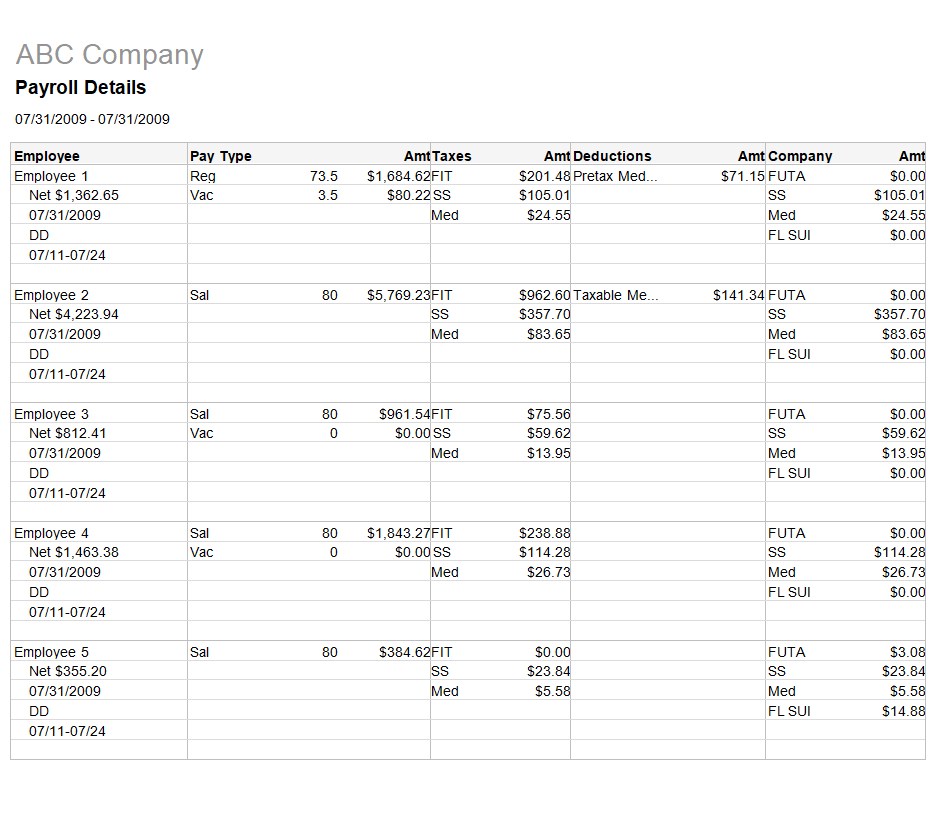

Company’s Detailed Payroll Report Template

File Size: 33 KB

What is a Payroll Report?

A payroll report or a payroll report template is a document that contains the details of the payroll costs of an organization. Usually, this cost is made up of different components like basic pay or wage, overtime payments and hours worked, deductions, vacation payments, bonuses, etc. A payroll report template is a pre-formatted payroll report to which one can simply add information and use the document for their own purposes.

The most common purpose of making a payroll report is to analyze the cost of the human resource to the business. An organization’s workforce plays an integral part in the overall growth and development of the organization. Every employee plays their part and contributes their maximum to the organization in their individual capacities. Their efforts and hard work are then paid off by the organization in the form of a monthly salary or daily wages, depending upon the type of the organization and the nature of its operations.

Importance of a Payroll Report?

As the workforce is an integral part of the organization, its cost is also integral for the business. This cost must be properly calculated and added among the other costs of the business. After aggregating the total payroll cost, it must be deducted from the gross profit of the company. To estimate the payroll costs in a proper way, a payroll report or a payroll summary report is then prepared.

A payroll report helps the decision makers of the business to analyze and make major decisions. The records and details from a payroll summary report are used by the accounts department to match the payroll costs of the payroll report and the financial statements. The employers also use such a report to calculate the relevant tax liabilities. Moreover, the payroll reports can also be used for audit purposes in order to verify the financial records and financial information.

The payroll reports contain a complete record of an employee’s pay for a specific time period. In case any employee raises an objection regarding his pay, any underpaid amount, deductions, or any arrears, the payroll report can be used to resolve any issues or discrepancies.

MORE Payroll Report Word Templates

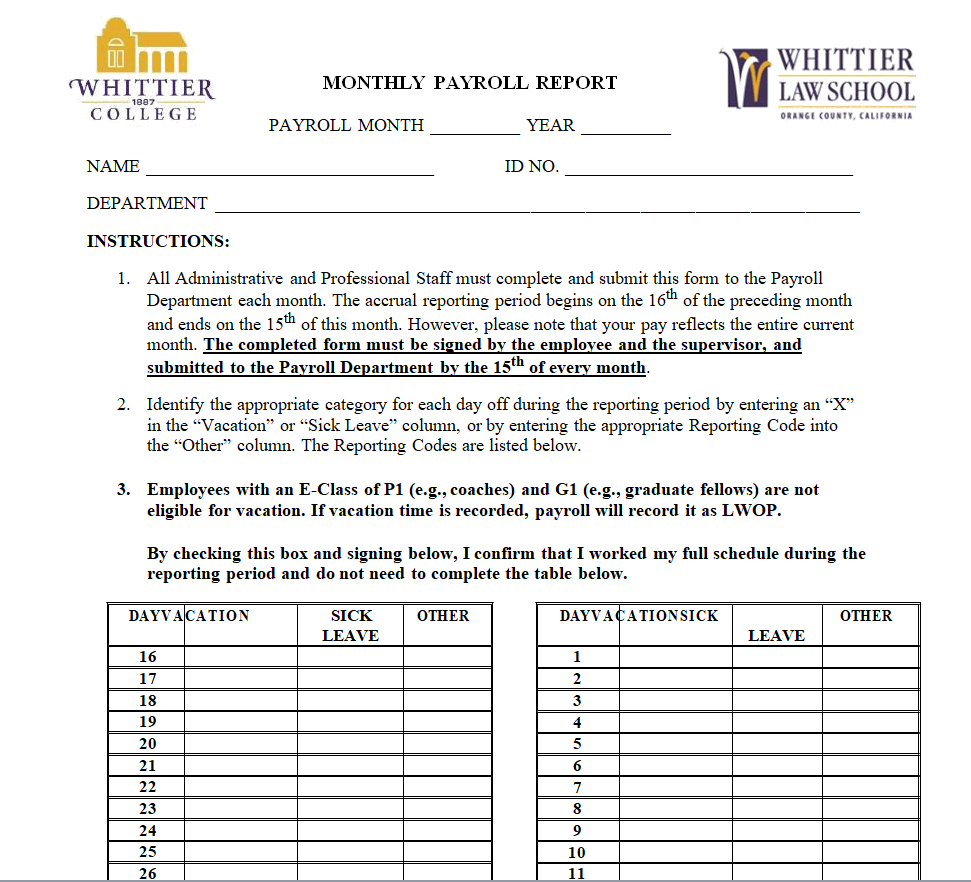

Monthly Payroll Report Format

File Size: 20 KB

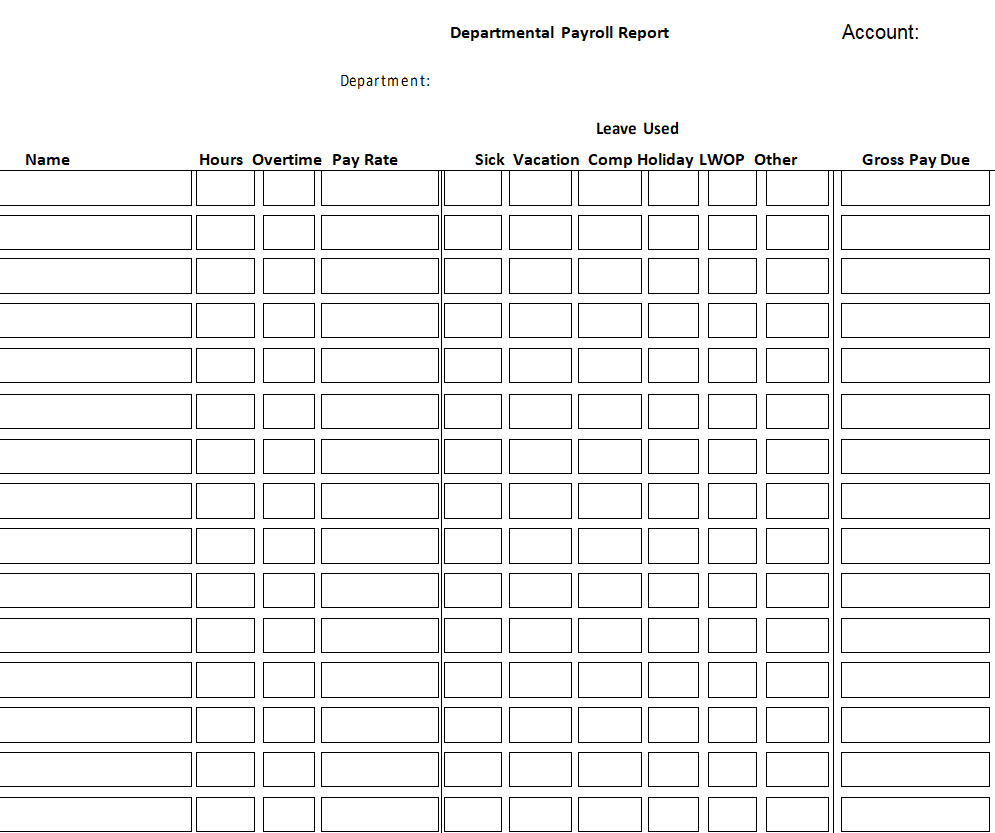

Departmental Payroll Report Example

File Size: 10 KB

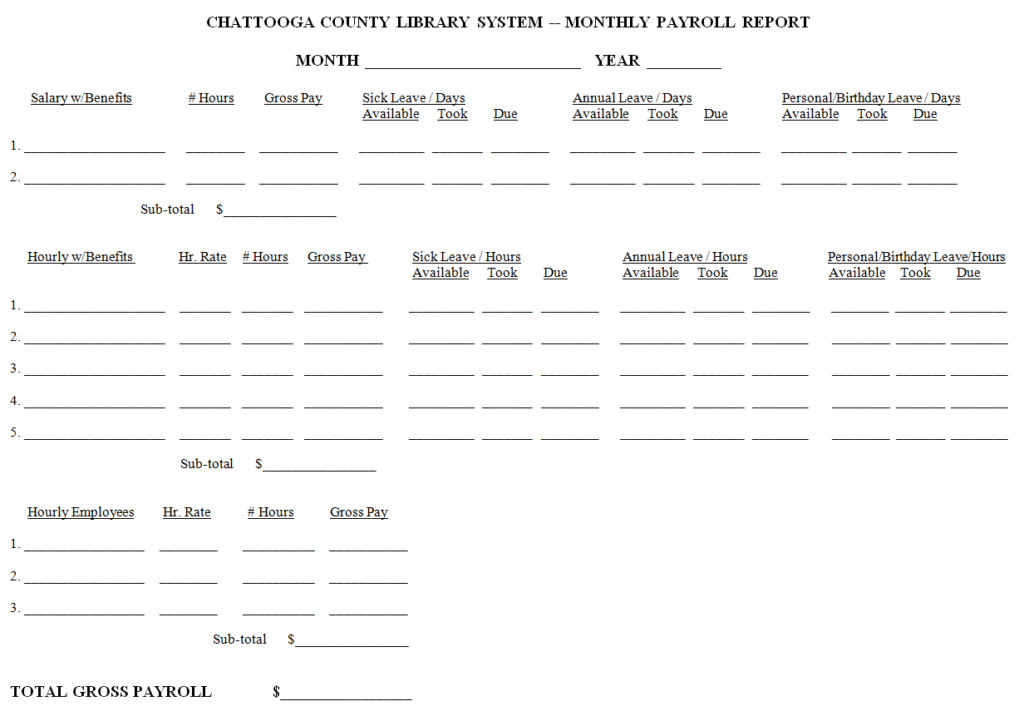

Fillable Monthly Payroll Report Template

File Size: 07 KB

Special Payroll Report Template

File Size: 51 KB

Employees Payroll Report Template

File Size: 21 KB

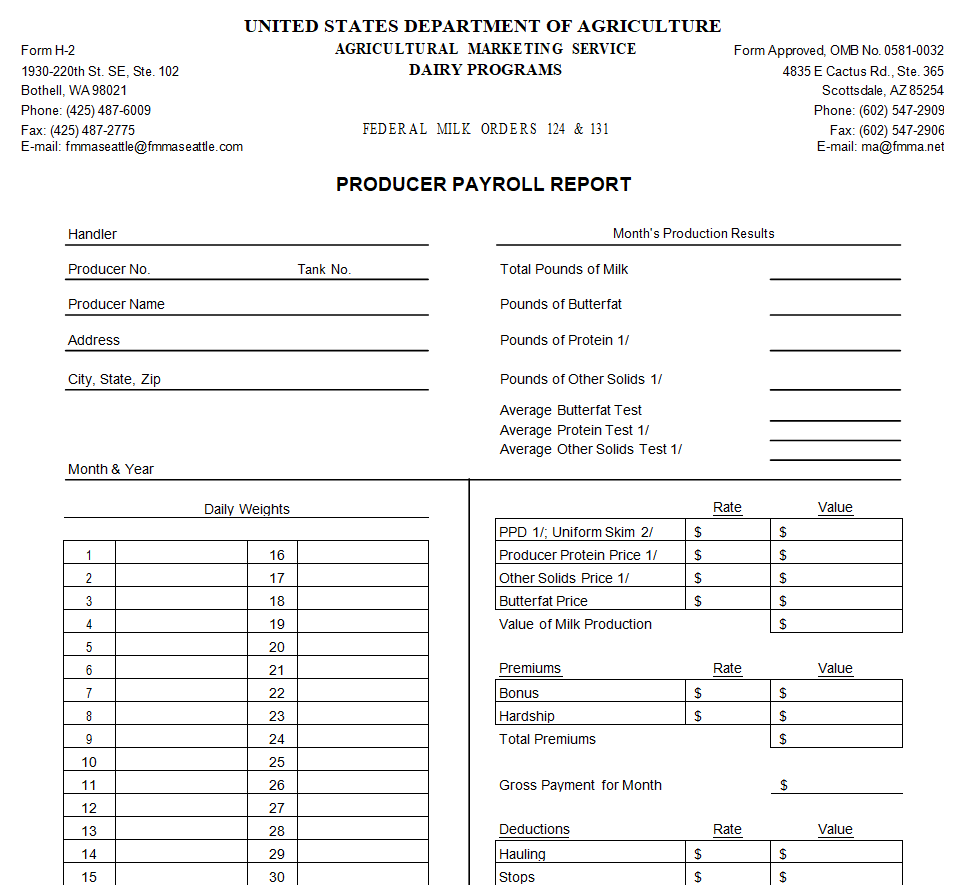

Agricultural Payroll Report Template

File Size: 15 KB

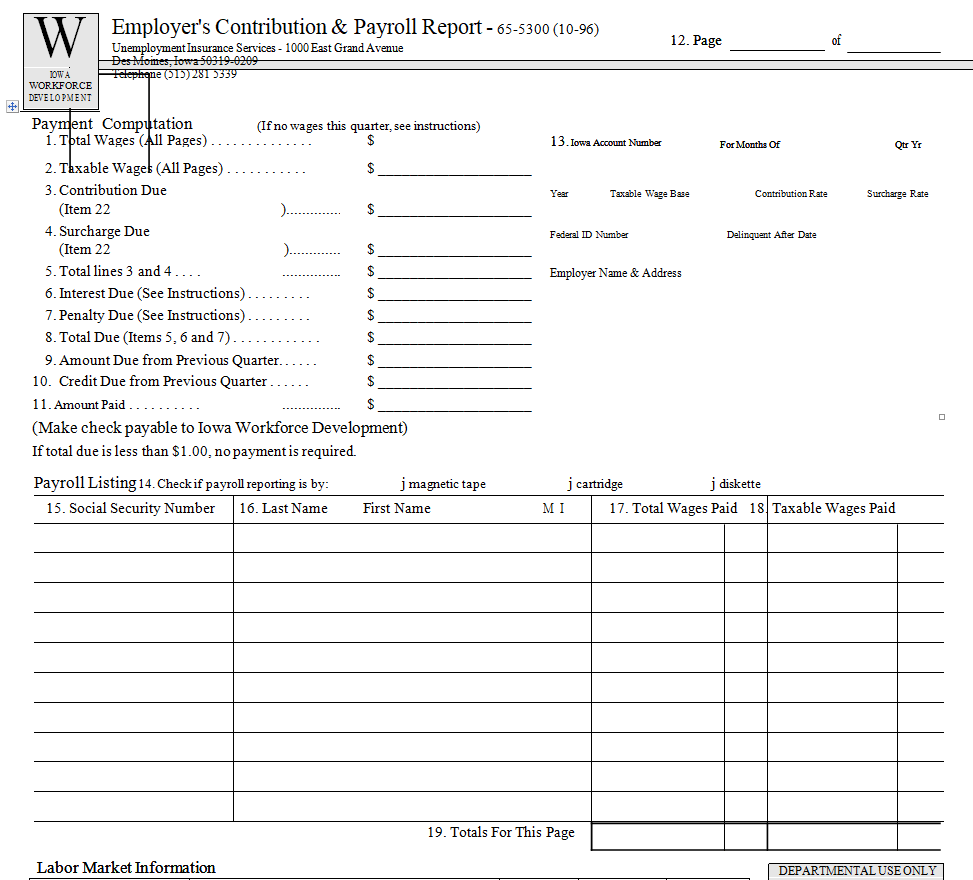

Employer’s Contribution & Payroll Report Sample

File Size: 12 KB

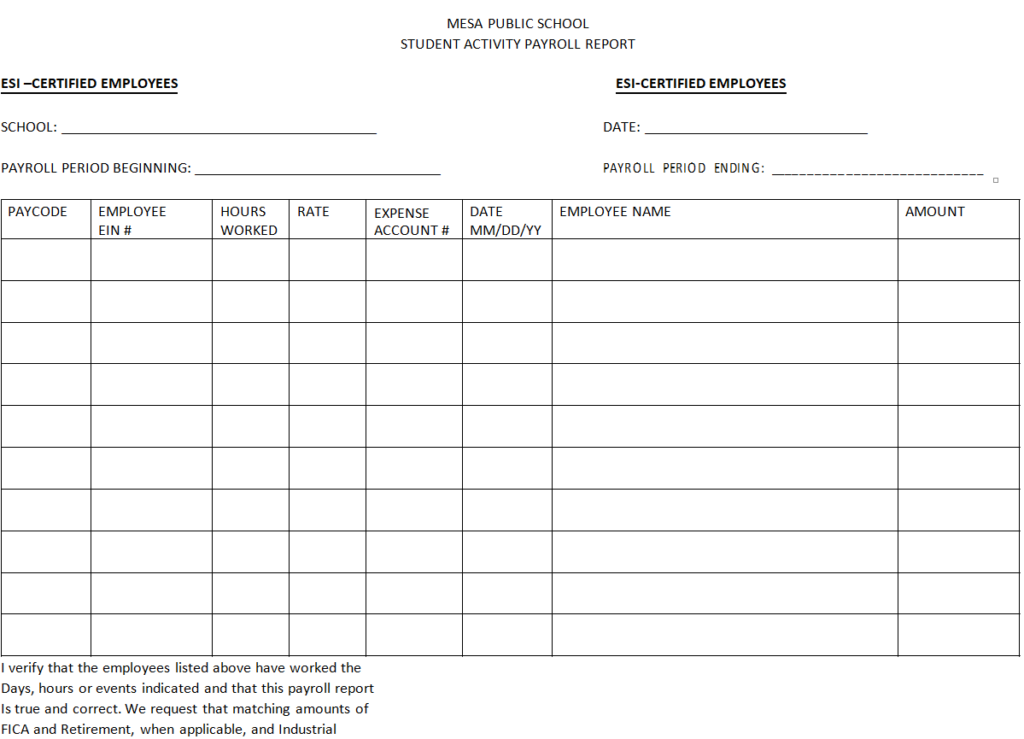

Student Activity Payroll Report Example

File Size: 03 KB

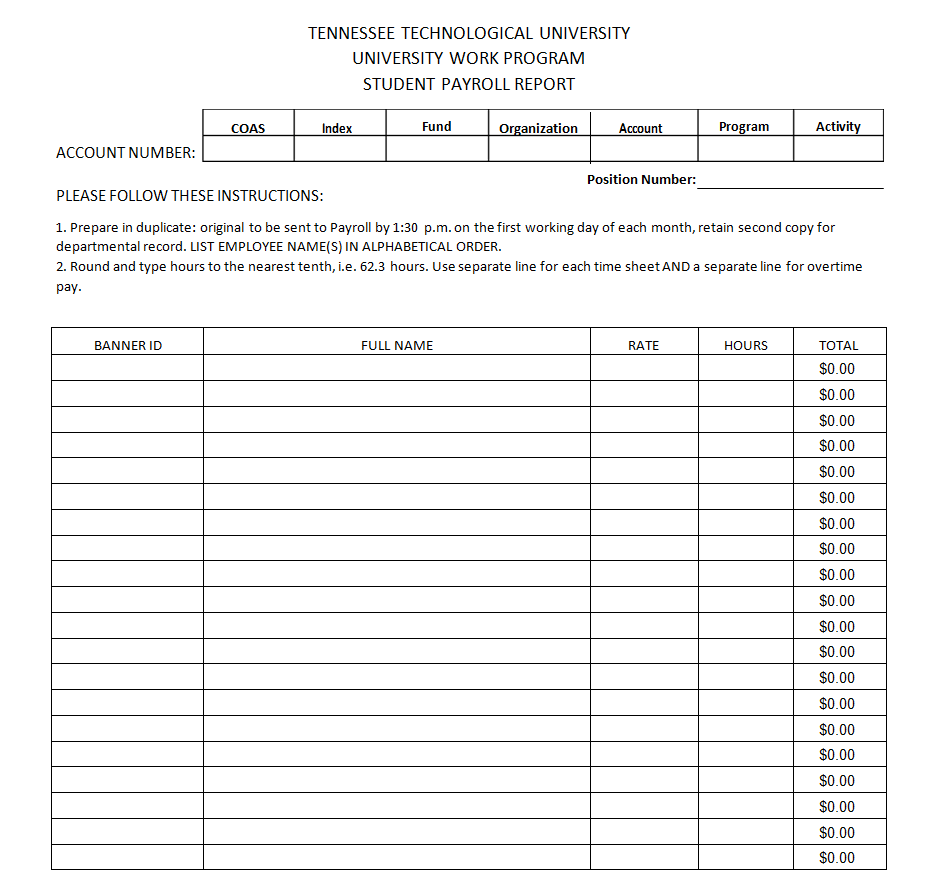

University Student Payroll Report Template

File Size: 07 KB

Sample Annual Payroll Report Printable

File Size: 09 KB

Editable Weekly Payroll Report Template

File Size: 12 KB

How to Make a Payroll Report?

As mentioned earlier, a payroll report can easily be prepared using a payroll report template. Using these pre-formatted payroll report samples will help you create a payroll report of your own within no time. All you have to do is to download the most suitable template, add your details or information to the payroll sheet, and you will have a handy payroll report ready for you to use.

However, if you are interested in creating a payroll report from the beginning, then you must know how to create a payroll report. In this section, you will get to know what must be included in a payroll report to make it useful for you. Given below is a list of important details that must be included in your payroll sheet or payroll report:

- Before beginning, you must know what information is required to be included in your payroll report. It depends upon the requirement of the report. You must gather and include all the relevant details and information and only include that in your payroll report.

- Decide a timeframe or time period for your report. Usually, this type of report is prepared on a monthly, quarterly, or yearly basis.

- Calculate the amount of gross pay for each employee. It is the amount of pay an employee is entitled to receive from an organization before any deductions or additions.

- Calculate the additions such as bonuses, overtime, medical benefits, or the amount of any other perquisites.

- Calculate the deductions such as the employee’s contributions to the provident fund or any other company plans. The deductions also include the amount of tax deducted at the source.

- After that calculate the amount of net pay which is calculated as, “Gross Pay + Additions – Deductions”. This is the amount that an employee actually receives from the employer.

- The payroll report also includes the contributions made by the employer to the provident fund, retirement plans, workers’ welfare fund, or any other relevant plan or scheme. The relevant laws and authorities of almost every country require the employer to contribute to the above-mentioned schemes as well. The amount of any such contributions must also be added to the total payroll costs of the business.

- In the end, the payroll report must include a space for the signature of the employee’s supervisor and another space for the signature of the HR Manager of the organization.

Sample Payroll Report Templates in EXCEL

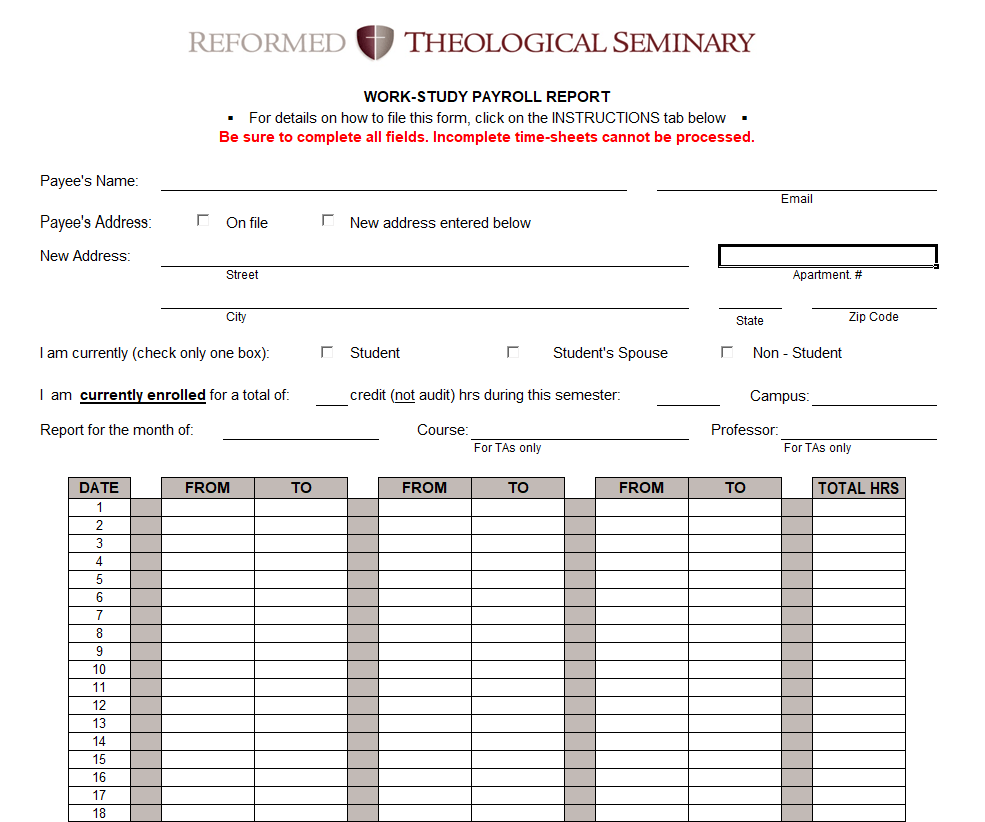

Work Study Payroll Report Form Sample

File Size: 82 KB

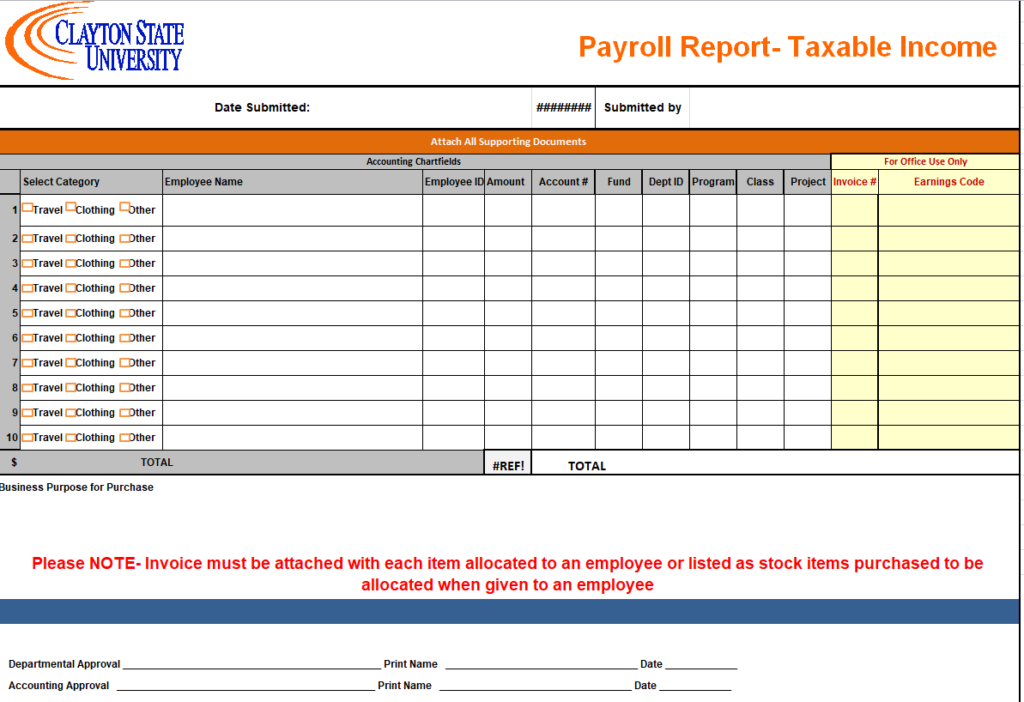

University’s Payroll Report Excel Template

File Size: 91 KB

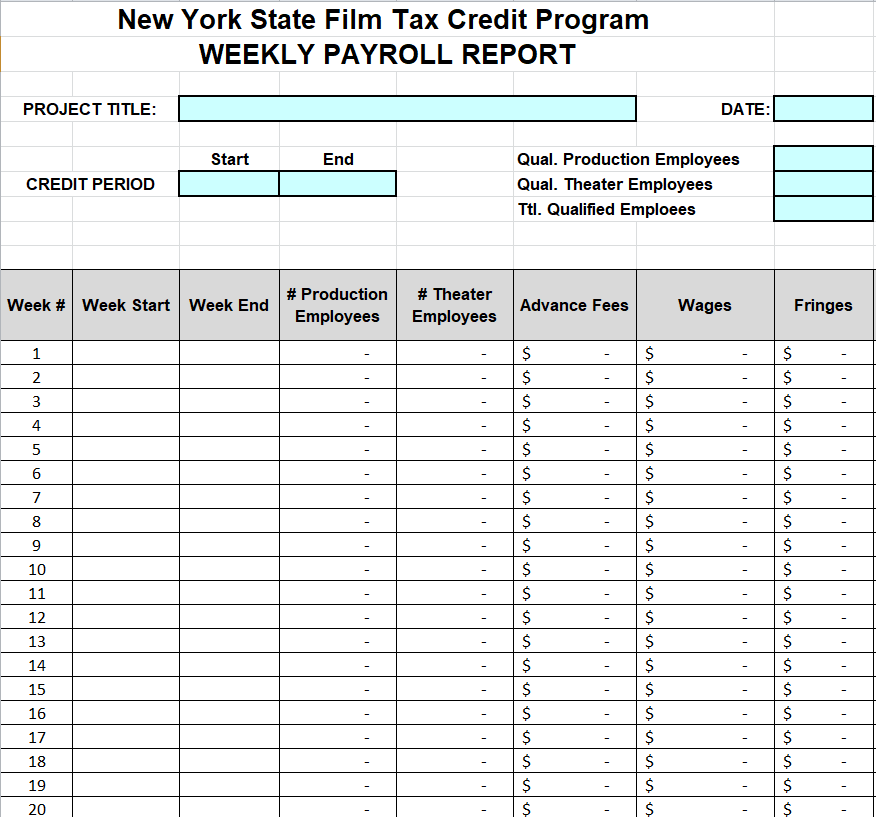

Weekly Payroll Report Excel Sheet

File Size: 59 KB

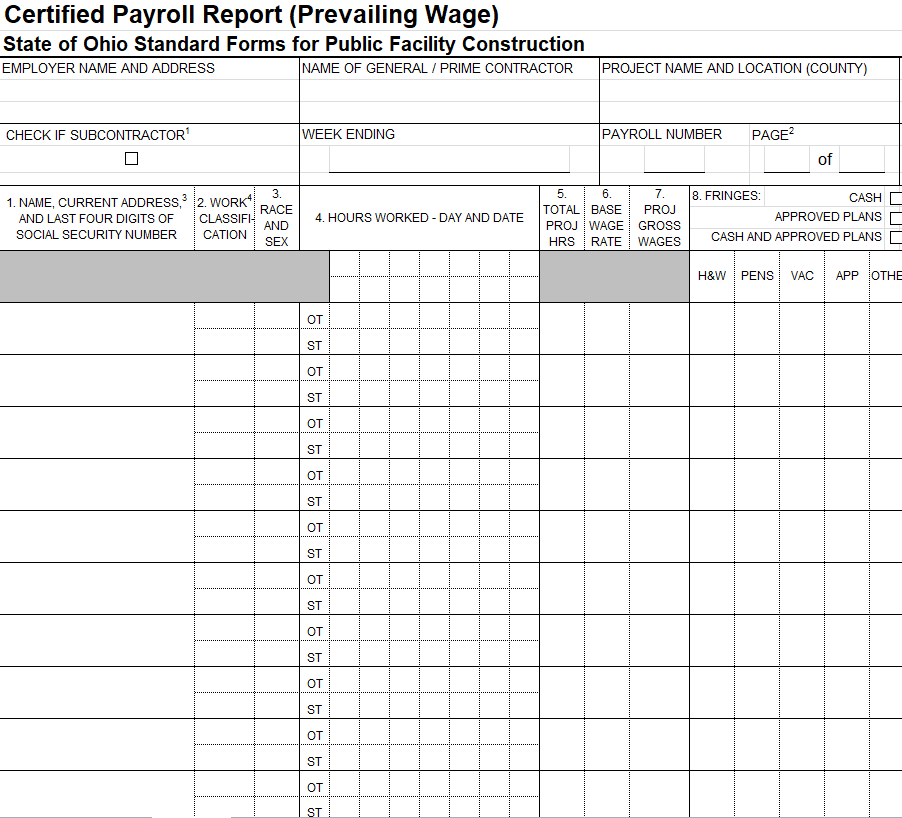

Certified Payroll Report Template in XLSX Format

File Size: 14 KB

Practical Payroll Report Template in MS EXCEL

File Size: 10 KB