We’ve curated a remarkable collection of highly customizable ACH Form Templates that will revolutionize your payment processes, all readily editable using popular word processing software like Microsoft Word. This definitive guide on ACH Form Templates will become your ultimate resource, elevating your financial transactions into the realm of effortless efficiency! ACH (Automated Clearing House) Form Templates stand as powerful tools, offering both businesses and individuals a secure and streamlined means to process electronic payments. Simplify your payroll processing as a business owner or effortlessly set up automatic bill payments as an individual, all with the user-friendly solution of ACH Form Templates.

The integration of ACH Form Templates into your financial operations comes with an array of benefits. Foremost, you bid farewell to the era of paper checks, reducing environmental impact while saving costs linked to printing and postage. The use of secure electronic transfers through ACH Form Templates bolsters payment security, leaving check fraud or transit losses in the distant past. Experience faster processing times, ensuring swift delivery of funds to their destinations, which translates to enhanced cash flow management for businesses and peace of mind for individuals.

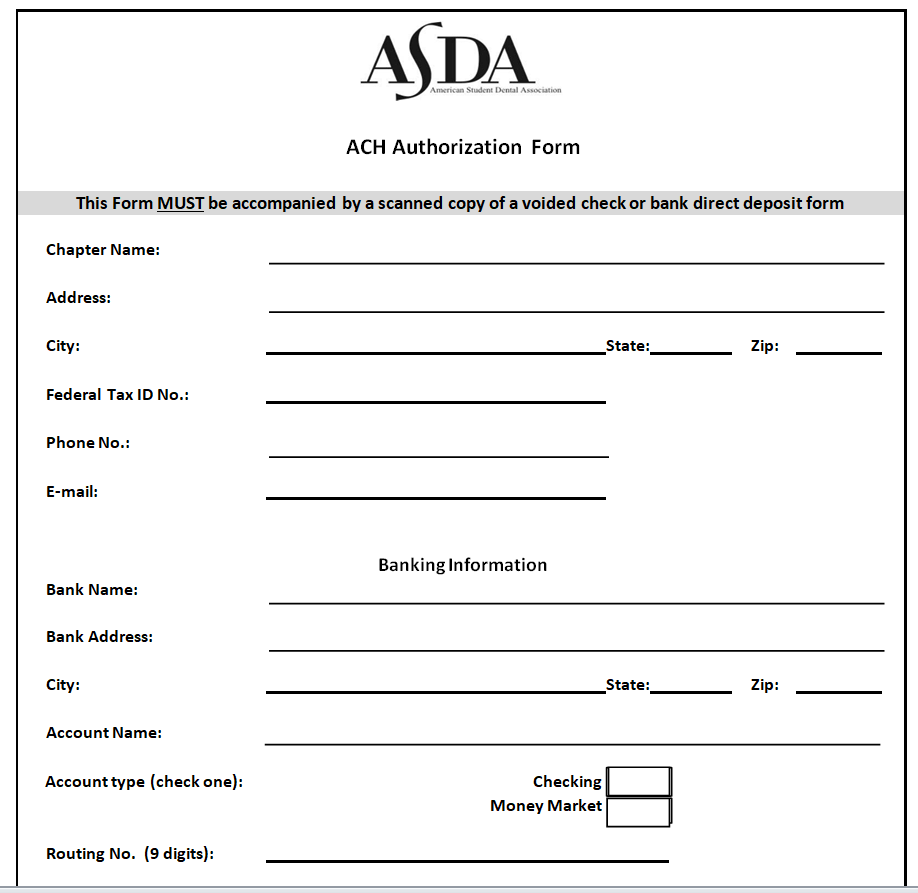

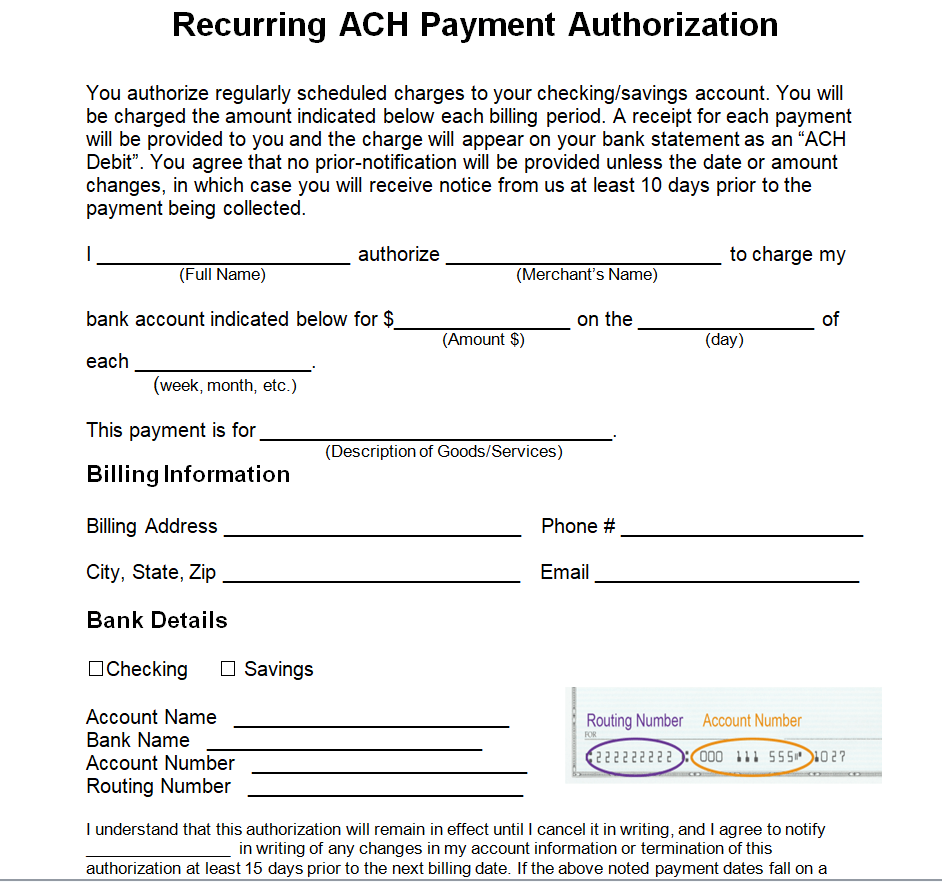

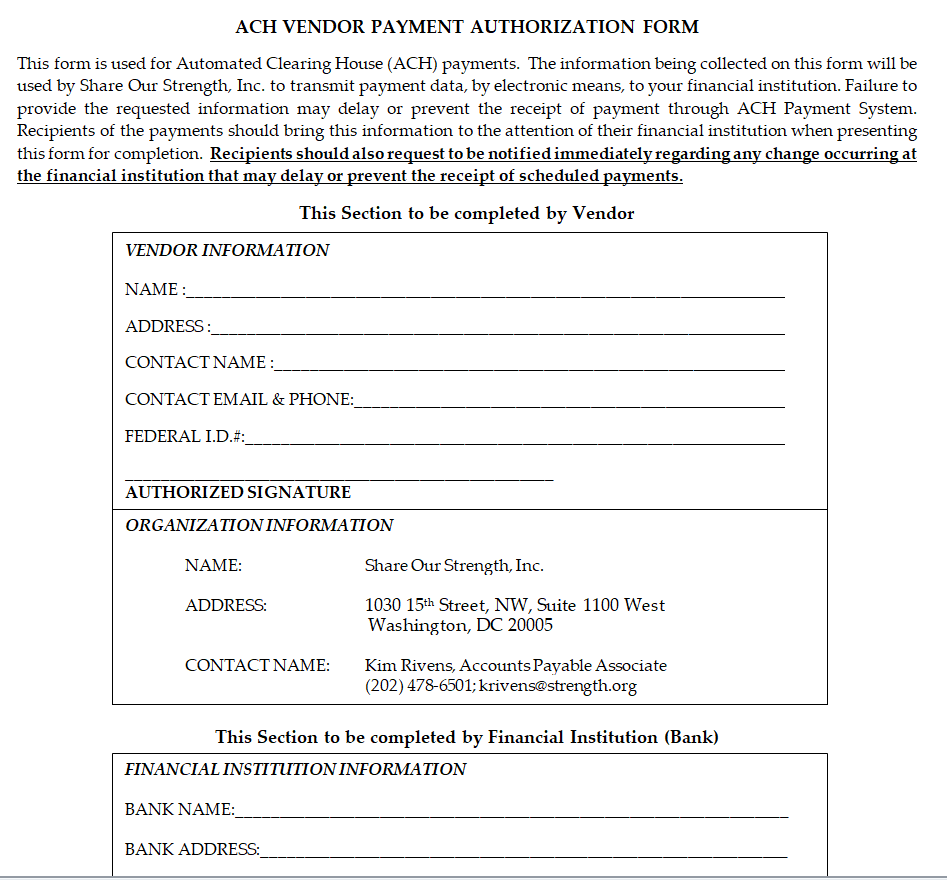

Built on a simple yet robust framework, ACH Form Templates make funds transfer between financial institutions seamless. To embark on this journey, simply download a suitable ACH Form Template, much like the hand-picked selection we’ve provided on this very page. Input essential payment details, such as bank account numbers, routing information, payment amount, and schedule. Once the template is complete, securely submit it to your financial institution, and let them handle the rest. The flexibility and customization options of ACH Form Templates let you set up one-time payments or recurring transactions tailored precisely to your unique requirements. Banks and financial institutions can now create a seamless ACH form with ease, thanks to these meticulously designed ACH Form Templates, saving them valuable time and effort in the process.

Get the Exclusive ACH Form Template Here

What is an ACH Form?

An ACH form, short for Automated Clearing House form, is a document used to authorize electronic transfers of funds between bank accounts. It serves as a powerful tool to initiate ACH transactions, which are secure, fast, and cost-effective ways to move money electronically. ACH payments are commonly used for various financial activities, such as direct deposits, bill payments, online purchases, and more.

Elements of an ACH Form:

- Individual/Enterprise Details: This essential section gathers all the pertinent particulars of both the initiator (sender) and beneficiary (receiver). Required information encompasses full names, physical addresses, and relevant account identifiers.

- Authorization Particulars: Serving as a legally binding authorization, the ACH form empowers the sender to initiate electronic fund transfers from their bank account to the recipient’s account. Comprehensive details may include the exact amount, options for one-time or recurring payments, and the date of transaction initiation.

- Banking Information: Crucial to the seamless execution of the ACH payment, this section captures vital data concerning both the sender’s and recipient’s bank accounts. This includes distinctive routing numbers and individualized account numbers.

- Signature and Date: A vital component, the sender’s authentic signature, and the date of authorization act as undeniable validation for the ACH transaction. This ensures the sender is fully aware of and consents to the electronic fund transfer.”

How Does an ACH Form Work?

Once you complete and authorize an ACH form, the originator’s financial institution (the sender’s bank) processes the transaction. The information provided on the form is securely transmitted to the ACH network, a nationwide electronic payment system that facilitates the movement of funds between banks.

The ACH network acts as an intermediary, batch-processing numerous transactions at set intervals throughout the day. The receiver’s financial institution (the recipient’s bank) then credits the funds to the recipient’s account.