Annuity statement examples are provided here on this page for you. These free annuity statement examples will help you easily understand what an annuity statement actually is and what is its purpose. So, make sure to scroll down and check what is an annuity statement, what to include in an annuity statement template, and the importance of an annuity statement.

What is an Annuity Statement?

An annuity statement is an official legal document that is provided to an annuitant i.e., an annuity holder. This document is provided typically on a regular basis (such as annually or quarterly) so as to indicate the current status of their annuity contract. The statement typically includes information such as the current value of the annuity, the interest rate being earned, and any recent transactions (such as contributions, withdrawals, or payments made to the annuitant).

An annuity is a financial contract between an individual and an insurance company, in which the individual makes a lump-sum payment or series of payments. In return for these payments, the insurer (insurer company) agrees to make periodic payments to the individual, either for a fixed period of time or for the lifetime of the individual. Annuities can be used for a variety of purposes, such as retirement planning, wealth accumulation, and income generation.

Many insurance companies have their own annuity statement templates in place. An annuity statement template is a standard format of an annuity contract that includes the various details of the annuity contract itself. The type and nature of the annuity statement template can vary depending on the nature of the annuity contract, the type of insurance company, and many other factors. Make sure to check the annuity statement examples that are provided here in this article.

FREE Annuity Statement Examples

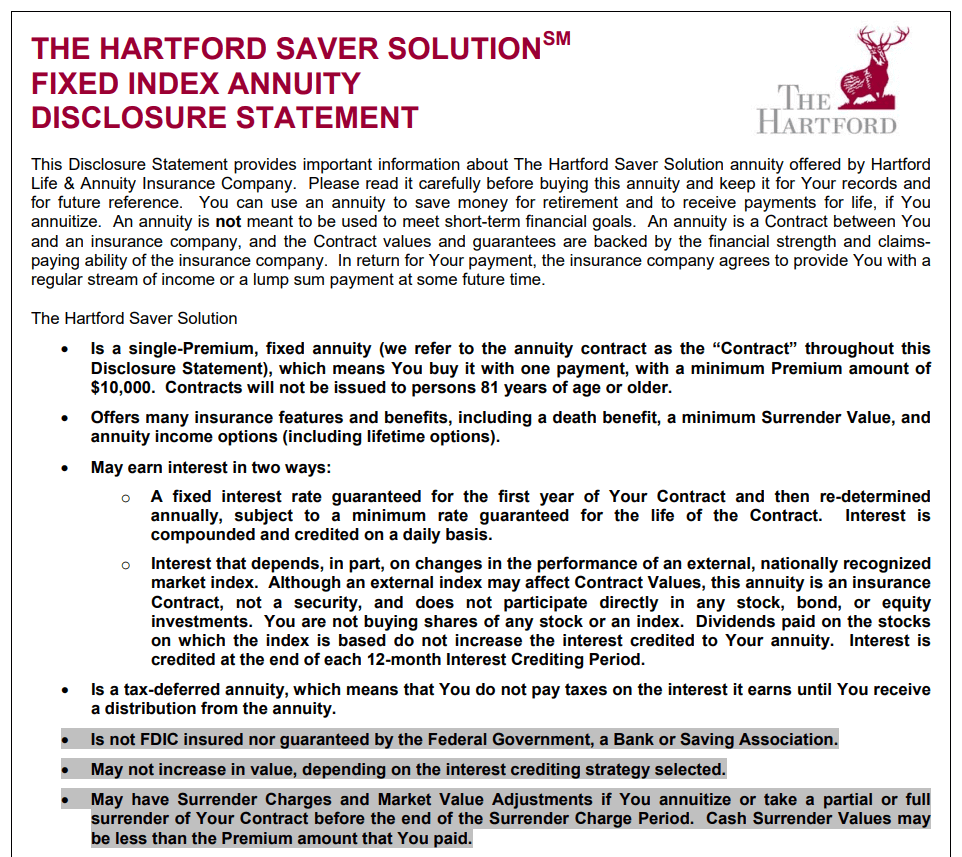

Fixed Annuity Statement Example

File Size: 192 KB

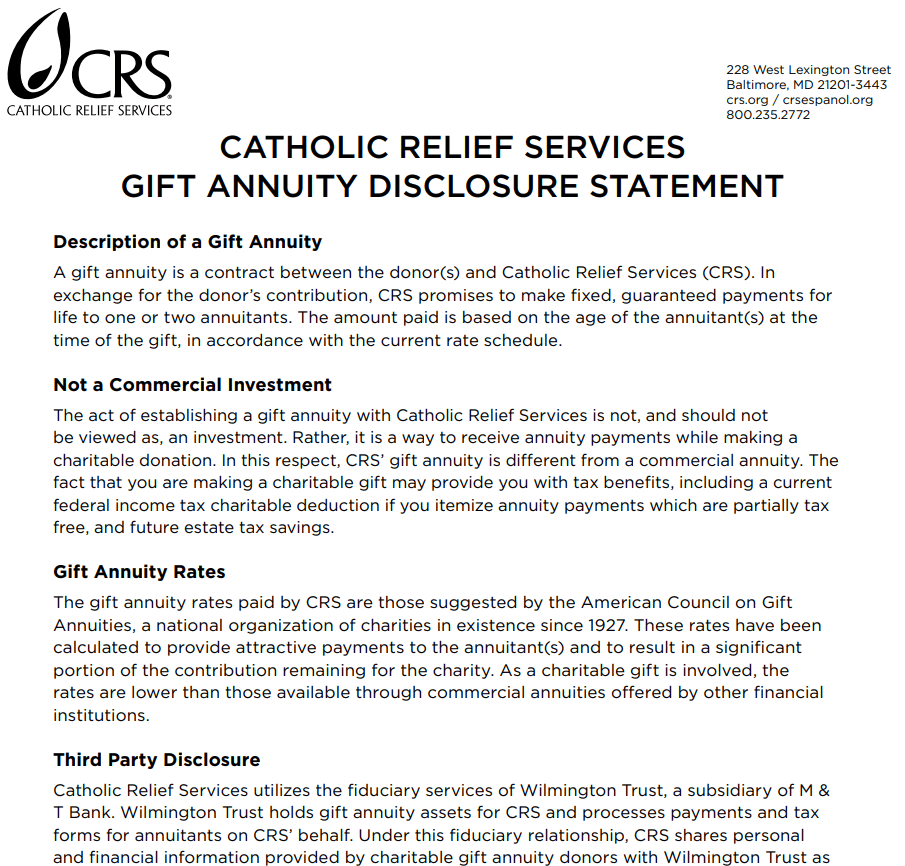

Gift Annuity Disclosure Statement Example

File Size: 43 KB

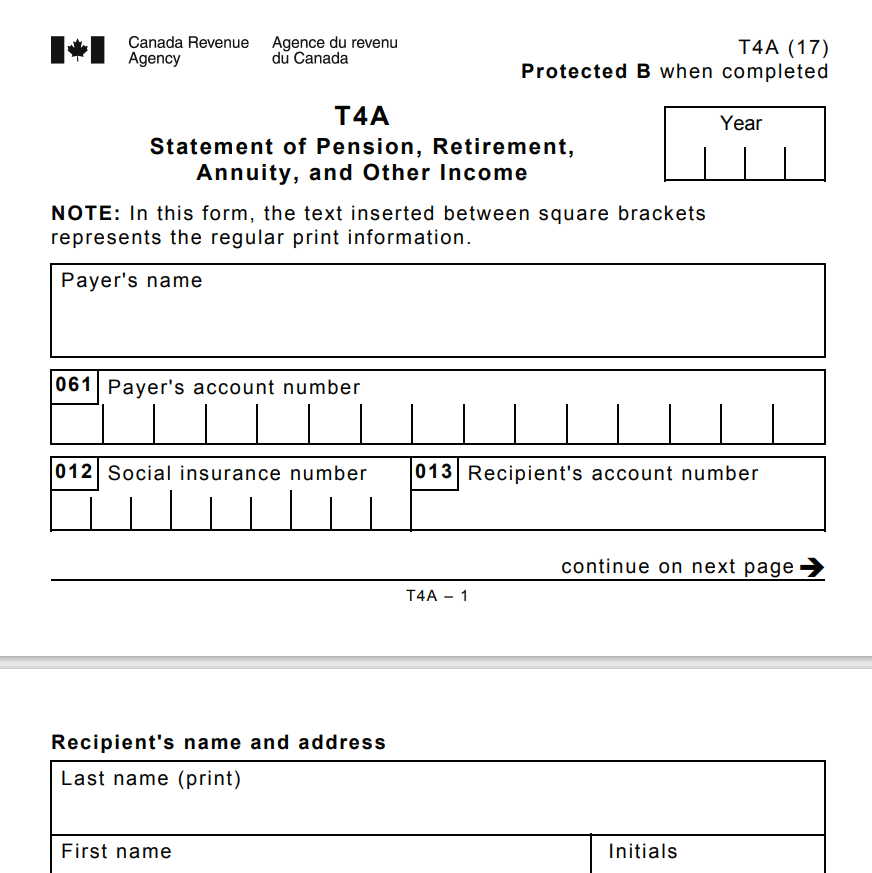

Blank Annuity Statement Example PDF

File Size: 93 KB

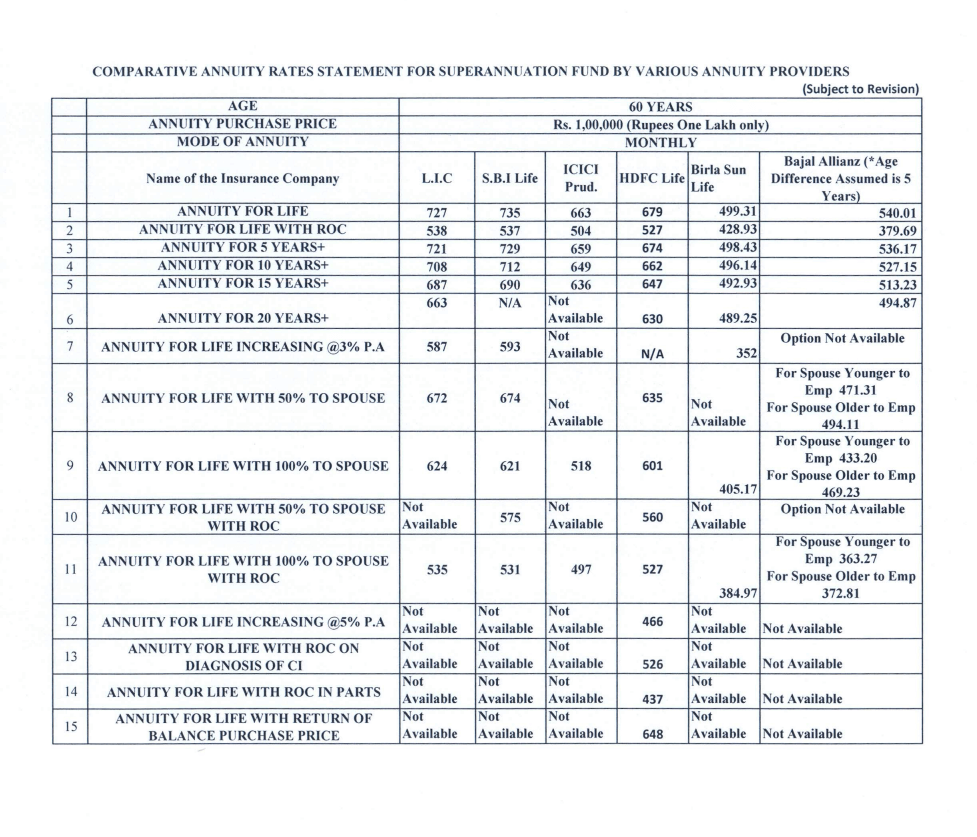

Comparative Annuity Rates Statement Example

File Size: 01 MB

Deferred Annuity Statement Sample PDF

File Size: 477 KB

Charitable Annuity Statement Example MS WORD

File Size: 513 KB

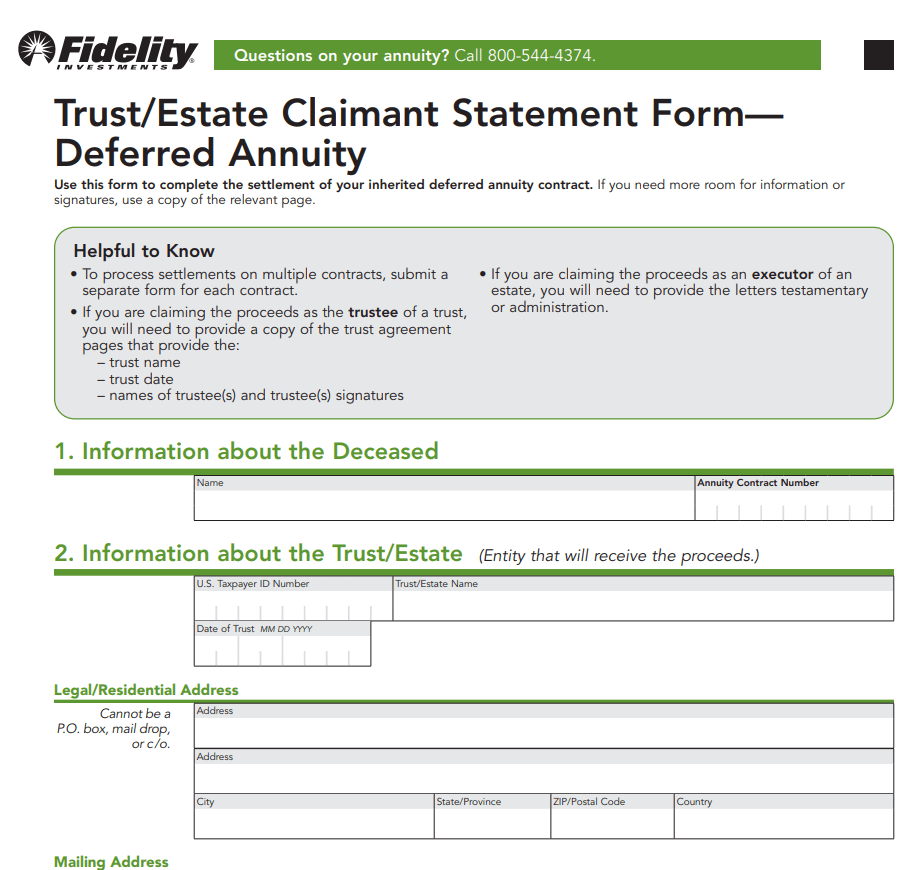

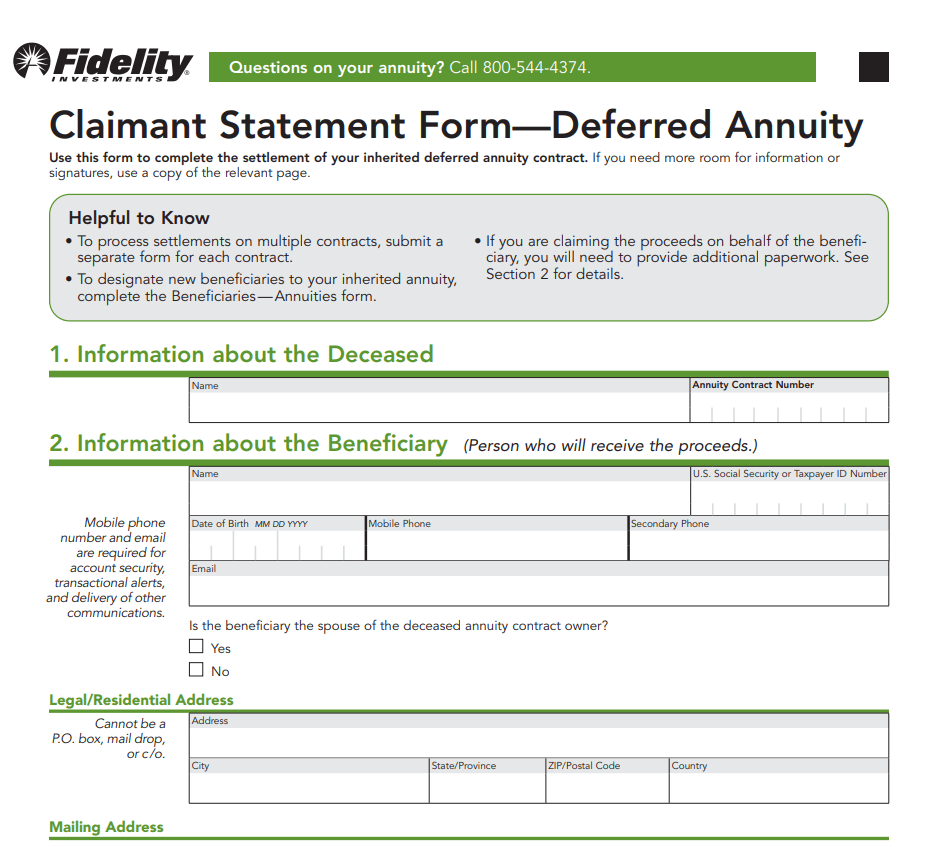

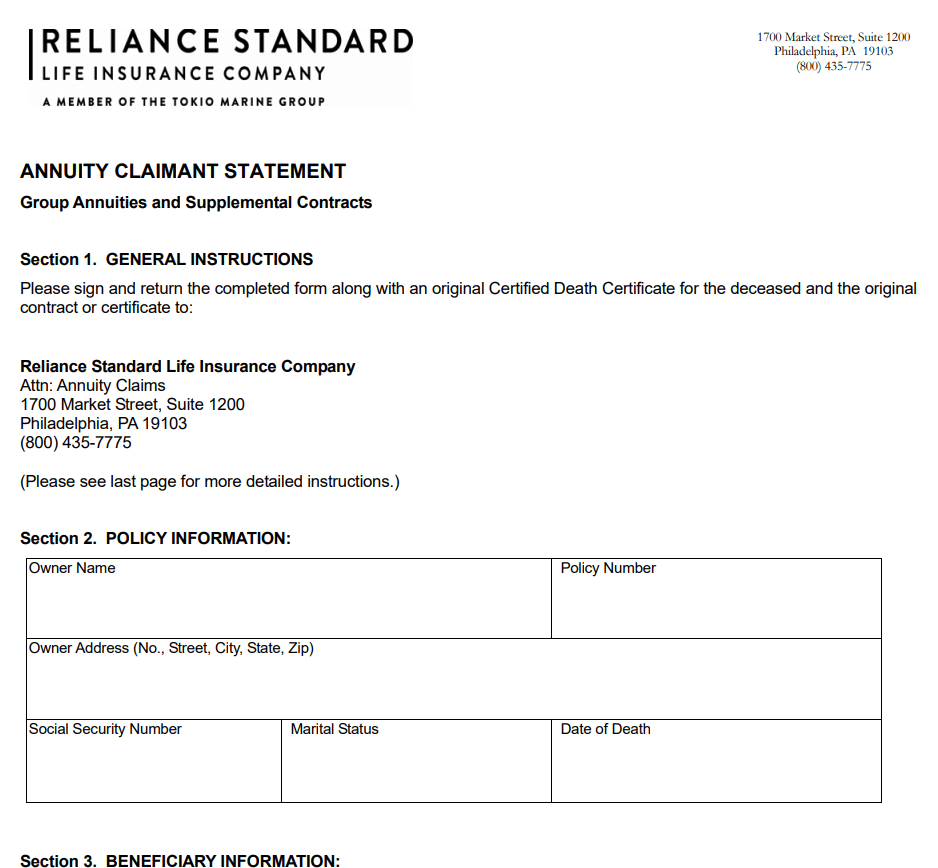

Deferred Annuity Claimant Statement Form Example

File Size: 63 KB

Importance of an Annuity Statement

An annuity statement is quite an important document both for the annuity holder and the insurance company. The given below list can further highlight its importance:

- An annuity statement is of great importance when it comes to understanding the terms and conditions of the annuity contract. It provides a detailed overview of the annuity contract such as the duration of the contract, amount of payment, frequency of payments, any fees or charges, and many other important details.

- Annuity statements are also used to determine tax liabilities.

- With the help of an annuity statement, you can easily determine the present value of the losses or gains that have been incurred. This way you can easily track the growth of the annuity.

- An annuity statement can also help you devise your retirement plan depending on the income that will be received as a result of any such annuity.

- The annuity statement can also help you track the beneficiaries of the annuity in case the actual annuity holder passes away during the annuity contract.

Online Annuity Statement Templates

New Annuity Statement PDF Template

File Size: 02 MB

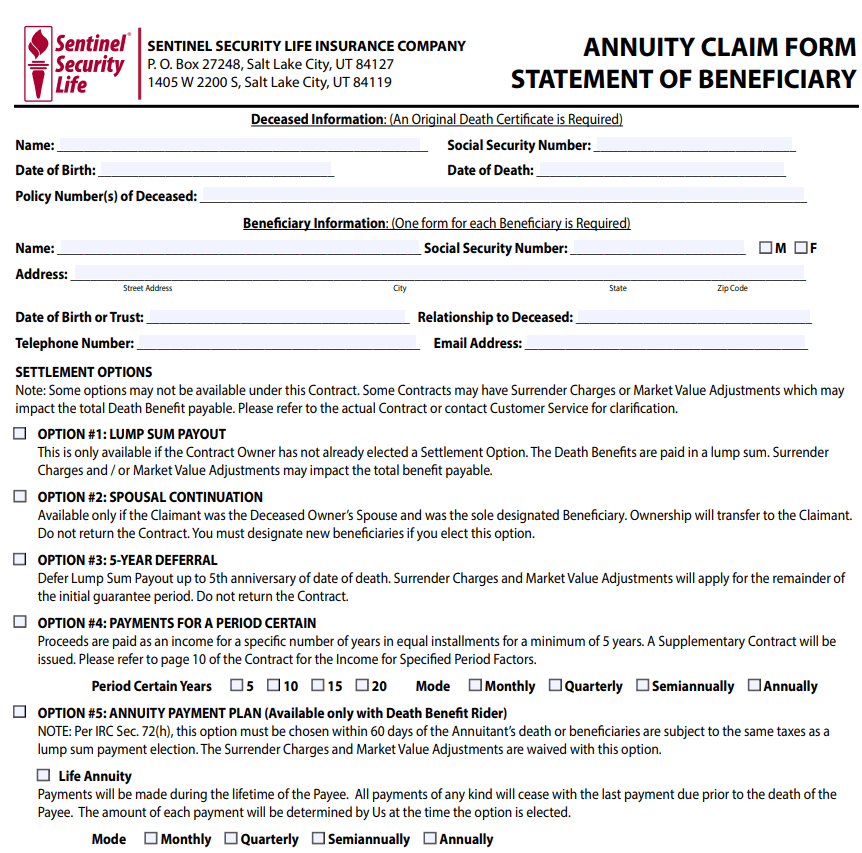

Fillable Annuity Claim Form Beneficiary Statement Template

File Size: 44 KB

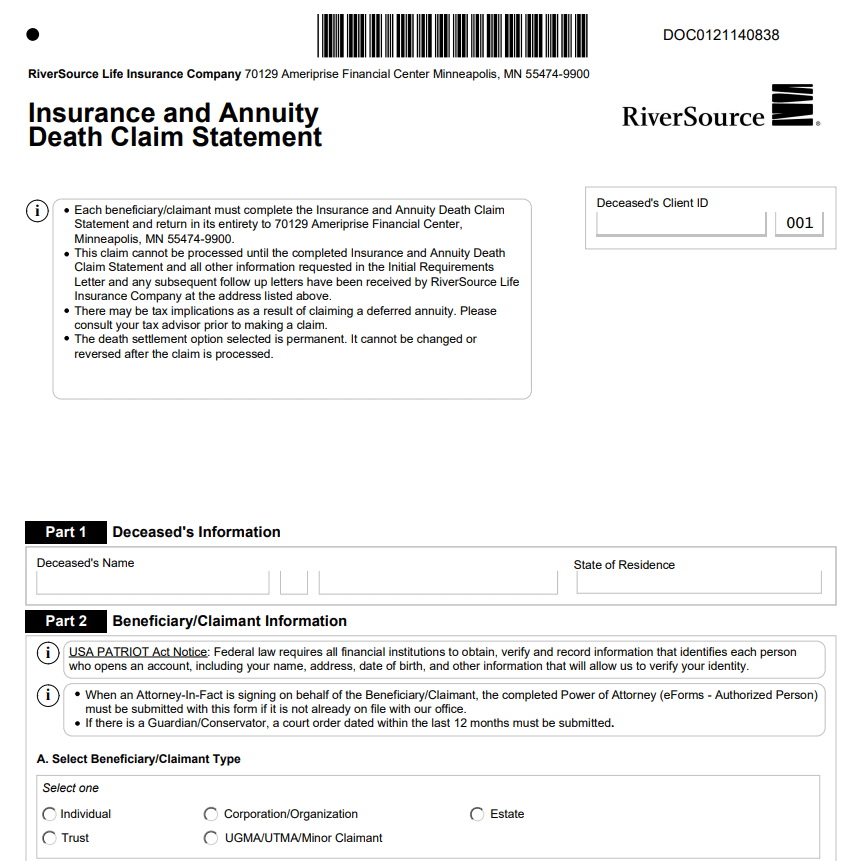

Insurance and Annuity Death Claim Statement Sample

File Size: 835 KB

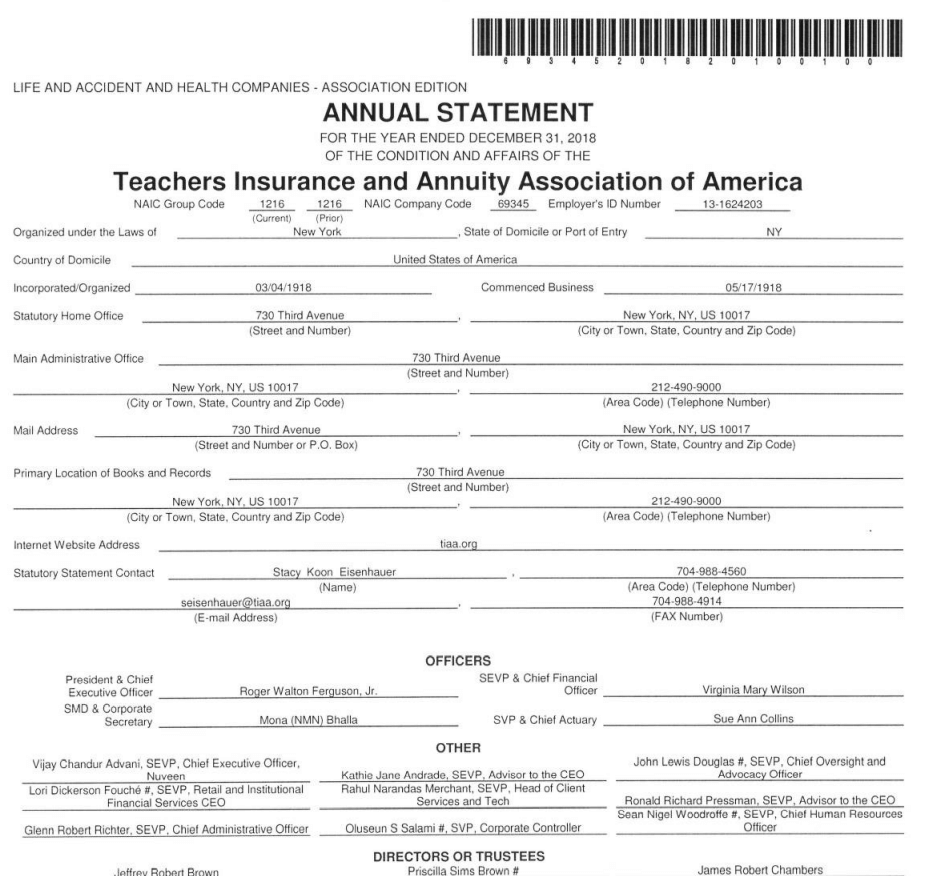

Teachers Insurance and Annuity Statement PDF Template

File Size: 27 MB

Sample Fixed Annuity Suitability Statement Template

File Size: 100 KB

Annual Charitable Annuity Statement Word Template

File Size: 17 KB

Company’s Printable Annuity Statement Template in PDF

File Size: 114 KB

What to Include in an Annuity Statement?

An annuity statement is an official document issued by the insurance company to the annuity holder. As it is a formal document, so make sure to include all the necessary details in it. Usually, an annuity statement template includes the following information:

Details of the Annuitant:

Name and contact information of the annuitant i.e., the person who actually is the annuity holder.

Details of the Contract:

Details of the annuity contract like policy number, type of annuity (Fixed, Variable, Immediate, Deferred, etc), and the value of the contract.

Transactions History:

The transaction history of the annuity contract which typically includes premium payments, withdrawals, and any other transaction related to the annuity.

Interest Rate and Amount:

This section includes the rate of interest and how much interest related to the annuity has been credited.

Surrender Value :

Surrender value is the amount the annuity holder would receive if they cancel the annuity before its completion.

Payment Details:

The payment details typically include the payment schedule, amount of payment, the next scheduled payment date, etc.

It is quite important to review your annuity statement every now and then so as to ensure that the information is accurate. Doing so will help you a great deal in keeping track of the performance of your annuity contract and your progress toward your financial goals.

If you got any queries related to the information contained in your annuity statement at any point in time, you should contact your insurance company or the agent who sold you the annuity for further explanation.